If there is indeed such a rational thought process taking place when corruption is being contemplated, what does it tell us about the Nigerian situation and what it will take for corruption to be eradicated?

In a recent survey, Nigerian respondents indicated that most of their national institutions were corrupt (Figure 1). Why is corruption so pervasive in Nigeria? Corruption is not an irrational act – if it were, we would have to conclude that majority of Nigeria’s entire political and public service class is insane. Corruption is a calculated, measured and deliberate decision. It often requires meticulous planning that can involve long drawn out schemes like padding budgets, setting up fake companies, identifying fronts, coming to contractual terms with the fronts on what portion of the loot will be retained by them, masking investments & bank deposits as well as sabotaging audits and project completion assessments.

While corrupt officials – political and civil servants – know the benefits that they stand to make from engaging in corrupt activities, they also understand the cost of being caught. The fact that majority of these officials decide to proceed with corruption means that they believe the benefits far outweigh the costs.

If there is indeed such a rational thought process taking place when corruption is being contemplated, what does it tell us about the Nigerian situation and what it will take for corruption to be eradicated? In this article, results from a corruption focused survey of Nigerians and concepts from rational choice theory are used to explain why corruption pays in Nigeria.

Rational Choice Theory

The body of knowledge that deals with how human beings evaluate risk and uncertainty when making decisions is generally referred to as Rational Choice Theory. This is a mature field that incorporates economics and psychology into a common framework that helps us understand how a decision makers frames economic decisions that have some risk and uncertainty associated with them (e.g., medical procedures, corruption, games of chance, business transactions, etc.). The field has been advanced by insights from a number of leading researchers, amongst whom are several Nobel laureates (e.g., Herbert Simon, Daniel Kahneman, etc.). Rational choice theory has been applied to understand issues as diverse as the behavior of stockholders, economic cycles of boom and bust, criminal behavior, and a host of other behaviors.

The Benefits of Corruption

Every corrupt activity starts with a certain amount of wealth (W) that can be stolen. When the perpetrator determines to corruptly enrich themselves, there is a probability (P) associated with whether or not the corrupt activity will be successful. If the corrupt person is for example, a Governor responsible for a state’s budget, or a Director in the Ministry, responsible for implementing a particular budget item, they call the shots and the probability that the corrupt action will be successful is 100%. If the perpetrator was an accountant without executive authority who is trying to steal by trying to cook the books, the probability of success will be less than 100%. This is because the success of their actions will depend on other factors beyond their control such as lack of external audits, inadequate assessment of project completion, etc.

Choice theory is based on simple and intuitive concepts. It assumes fundamentally that given an option, W, which has a probability of occurrence, P, the expected benefit from selecting that choice is given by the multiplication of the option, W and the probability P.

In simple mathematical terms, the expected benefit from the corrupt action is given by the formula:

Expected Benefit = Wealth (W) x Probability of Successful embezzlement (P) = W x P

The Costs of Corruption

The costs of corruption, C, refers to the penalty that is associated with the discovery and prosecution of corrupt practices. The costs are dependent on two things: (i) the likelihood that the corrupt action will be uncovered, exposed and filed for prosecution, and (ii) the likelihood that the corruption case is successfully prosecuted in the courts and an adequate punishment is meted out to the perpetrators.

The probability, P' that the costs of corruption will occur is quantified as:

Probability of cost (P') = Probability of exposure & prosecution (P2) X Probability of successful prosecution (P3).

Just like the case for the expected benefit, a similar quantification of the expected cost of corruption can be determined. The cost of corruption can range from serving a prison term, to forfeiture of the proceeds of corruption, publish shaming, family dishonor, professional & career damage (e.g., disbarment for lawyers, or loss of licensure for accountants and engineers).

Given a Cost, C, with a probability of occurrence, P', the expected cost of corruption is given as:

Expected Cost = Cost of Corruption (C) x Probability that the cost will occur (P') = C x P' = C x P2 x P3

By subtracting the expected cost from the expected benefit, the net benefit of the corrupt action can be determined. In this case, we can mathematically state that:

Expected Net Benefit = Expected Benefit - Expected Cost = W x P - C x P'

Whenever the Expected Net Benefits are greater than zero, the choice is one that a rational decision maker is expected to make. If the Expected Net Benefits are negative, the rational thing to do is to turn down the option because the costs far outweigh the benefits.

Nigerians speak on costs of corruption

In order to obtain quantitative values for the probabilities to be used in assessing the expected net benefits for corruption in Nigeria, we asked respondents to assess the likelihood that corrupt officials would be exposed and arrested (see Figure 2). Based on the responses, a weighted average value can be determined which indicates that Nigerians’ perception of the probability that a corrupt official will be exposed and arrested is 31%.

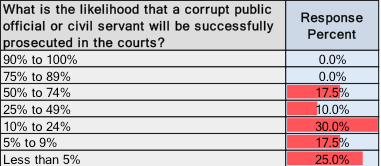

We also asked respondents to assess the likelihood that corrupt officials would be successfully prosecuted in the courts (see Figure 3). Based on this result, Nigerians’ perception of the probability that a corrupt official will be successfully prosecuted is 21.5%.

Corruption Case Studies:

Now that we have a decent handle on rational decision theory we will apply the concept to two hypothetical corruption cases. Results from the survey will be used for ascribing the probabilities needed for the expected net benefit estimations.

Case 1: Current Enforcement Regime (P2 = 31%, P3 = 21.5%)

A 45 year old Director General in the Nigerian Civil Service earns N8m annually (including allowances, rent and home ownership subsidies and other emoluments). He has the opportunity to corruptly enrich himself to the tune of N10 m. If caught, he will suffer reputational damage for the rest of his life, spend some time in jail and lose his pension entitlements. He estimates that the losses he will suffer if caught and prosecuted will come to about N5 m annually. These losses can be calculated as a perpetuity, which at an assumed 10% interest rate gives estimated lifetime losses of about N50 m. He estimates that there is a 31% chance that he will be caught, and a further 21.5% chance that he will be successfully prosecuted. Should he corruptly enrich himself?

Answer: Yes, corruption pays! The Expected Net Benefit is positive (+N6.7 m).

Probability of getting embezzled amount (P1) = 100%

Probability of getting caught (P2) = 31%

Probability of getting prosecuted successfully (P3) = 21.5%

Estimated Lifetime Cost (C) = N50 m

Gains from Corrupt enrichment (W) = N10 m

Expected Net Benefit = P1 x W - P2 x P3 x C

Expected Net Benefit = 100% x 10 m - 31% x 21.5% x 50 m = 10 – 3.3 million = N6.7 m.

Case 2: High Enforcement Regime (P2 = 50%, P3 = 50%)

Consider the case of the same civil servant. Assume that now the enforcement and judicial environment is radically different. The government has instituted a policy that rewards whistleblowers who report corrupt officials with 2.5% of the total embezzled amount. There is also a 2.5% bonus reward that goes to the lawyers who prosecute the cases if there is a successful conviction. These developments have caused the probability of getting caught to increase to 50% and the probability of getting prosecuted to increase to 50%. Should the Civil Servant still corruptly enrich himself in this new scenario?

Answer: No, corruption does not pay! The Expected Net Benefit is negative (-N2.5 m).

Probability of getting embezzled amount (P1) = 100%

Probability of getting caught (P2) = 50%

Probability of getting prosecuted successfully (P3) = 50%

Estimated Lifetime Losses (C) = N50 m

Gains from Corrupt enrichment (W) = N10 m

Expected Net Benefit = P1 x W - P2 x P3 x C

Expected Net Benefit = 100% x 10 - 50% x 50% x 50 m = 10 - 12.5 = -N2.5 m.

3 Public Policy Implications for Nigeria

While these examples are hypothetical, the implications are clear – corruption will continue to thrive because the perceptions that Nigerians hold of the likelihood for exposure and prosecution are low. Their views are supported by the facts. For instance, none of the high profile cases that have been prosecuted since the inception of the Buhari government has been successfully prosecuted.

Here is the good news - the same survey indicated that Nigerians overwhelmingly support a stronger enforcement regime than what is currently in place (Figure 4). One striking feature of the survey responses was that none of the respondents believed that the current enforcement climate was adequate.

The self-interest of people and the proven rational basis for much of human behavior can actually be used as tools for cracking down on corruption. Rational decision theory suggests that if corruption is to be tackled effectively public policy must focus on three areas: (i) increasing the likelihood of getting caught, (ii) increasing the likelihood of prosecution and (iii) raising the penalties borne by corrupt officials.

Figure 4: Majority believe that stricter laws are needed to curb corruption

(i) Encourage whistleblowers so that the likelihood of catching embezzlers increases: There is always a long line of clerks, messengers, cashiers, accountants, personal bankers and auditors that are privy to every single act of corruption. Right now, these people keep quiet because there is no incentive to make them come forward with the information that they have. Imagine what would happen if a law was enacted that guaranteed a reward of 2.5% of the recovered proceeds of corruption to a whistleblower (the payout should probably be capped at N10m or so, otherwise the incentives become perverse). It is certain that the authorities would be inundated with all types of information about corrupt activities. As a consequence the likelihood that corrupt officials will be reported should increase, thereby increasing the costs to the perpetrators of corrupt activities.

(ii) Provide Incentives to Lawyers so that the likelihood of successful prosecution increases: Even where corrupt officials are arrested, we have seen situations where trials drag on forever, or the officials are let off the hook because of the ineptitude and sloppiness of the lawyers charged with their prosecution. To get prosecution rates up, it will be prudent to provide an incentive that rewards the successful and timely prosecution of cases. Guaranteeing some portion of the recovered sums to successful prosecutors could help in this regard. In the corporate world, where shareholders are faced with what is called the Principal-Agent problem, the commitment of the CEO and other executives to making sure that their (the executives') focus is on growing shareholder's wealth is secured by making stock options part of the compensation package. If the stock does well, then the executives benefit as well.

(iii) Increase the penalties associated with corruption: As the cases suggest, a critical element that determines the expected net benefit (or loss) of corruption is the magnitude of the lifetime loss suffered. In all the instances considered, if the lifetime losses had been more extreme, the expected net benefits of corrupt activity would have greatly reduced. Some of the steps that could be taken from a public policy perspective to increase the costs to the perpetrators of corrupt activities includes severely restricting the economic opportunities available to people convicted of corruption. For instance professionals like lawyers, doctors, and engineers who have been convicted of corruption could be stripped of their charters and/or licenses. Convicted embezzlers could be excluded from participation in the stock market and politics, and onerous forfeiture requirements could be imposed to make the lifetime losses large and significant. As the survey results indicate, Nigerians are even prepared for penalties as drastic as capital punishment to be prescribed as punishment for corruption.

Conclusion

Nigerian officials are corrupt because given Nigeria’s current law enforcement and judicial climate, corruption has a net positive payback. If anything is to change, then the enforcement regime must become stricter and less forgiving of corrupt activity. Rational choice theory provides a means for devising the policy instruments that can enable us effectively tackle the menace of corruption.

Dr. Malcolm Fabiyi coordinates the Governance Advancement Initiative for Nigeria (GAIN). You can follow him on Twitter @malcolmfabiyi and reach him at [email protected].