Up until March 2020, when it announced an end to under recovery, the corporation had been withholding revenue from the federation account in the guise of subsidy losses.

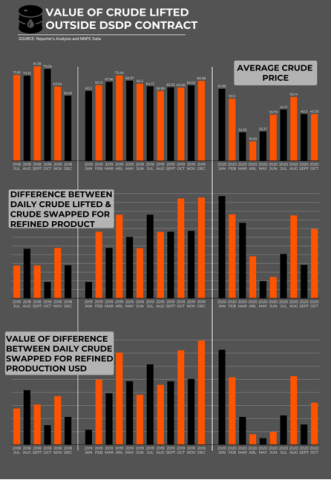

Within a 28-month window spanning July 2018 to October 2020, the Nigeria National Petroleum Corporation (NNPC) lifted crude worth $5.40bn beyond the Direct Sale Direct Purchase contract it has for refining its daily petroleum allocation of 445,000 barrels.

The state-owned firm executed this extra order, despite failure to lift up to 300,000 of the 445,000 daily allocation it ought to have been refining in its inactive refineries.

Up until March 2020, when it announced an end to under recovery, the corporation had been withholding revenue from the federation account in the guise of subsidy losses through two fronts, the oil swap for daily crude and the contract for the extra PMS which it referred to as ‘flush volumes’.

“Under recovery for DSDP (Domestic) is charged to the Federation account,” the corporation reported from August 2018. It had, however, started recording this nature of ‘under recovery’ (subsidy) since 2017. By DSDP domestic it means the under recovery charged to the importation of petrol sourced from Daily crude allocation.

“Under recovery for Flush Volumes and Extended DSDP is charged to the National Fuel Support Fund (NFSF),” the report states.

Its justification for the arbitrage dates back to December 2017, when Nigerians began to find themselves wedged in queues for petrol. The slow-dispersing lines remained part of the fixture in Nigeria’s major towns for over three months, finally clearing up in March 2018.

This was the first crisis the NNPC faced since it became the country’s sole importer of gasoline. For some unexplained reasons, the daily average of 41.48m litres it imported through its contract with select companies, including its own subsidiary Duke Oil in 2017, was not enough for Nigerians. The daily distribution of 37.60m litres, was also rendered grossly inefficient by the over three-month long shortage.

In the heat of the emergency, the National Assembly reportedly came down hard on the corporation, asking it ‘to find all ways possible to resolve the fuel supply crisis,’ NNPC spokesperson as at October 2018, Ndu Ughamadu said. In a swift response to the directive, the corporation set-up a ‘revolving fund’ – a fund that is continually replenished as withdrawals are made. The value of the account which became the NFSF was slightly over N383bn or $1.05bn.

Interestingly, the National Assembly, which had given the NNPC the go-ahead to find a solution, did not know or failed to speak of the NFSF account until October 2018. By that time, the NNPC had already bought crude worth $502.25m (N183.32bn) for its extended DSDP with money experts believe came from the NFSF. What the Senate (who accused the corporation of operating an illegal account for under recovery) and the NNPC failed to tell the public is when exactly the account was created as well as how much had been credited and debited from it as at October 2018.

Abiodun Olujimi, a Senator from Ekiti State, simply said the corporation had taken out $3.5bn from Nigeria Liquefied Natural Gas Limited to fund the NFSF. Former NNPC GMD, Mikanti Baru appeared in November 2018 to defend his corporation’s arbitrary decision to take out money from the federal coffers without approval, he said the NNPC had to extend its DSDP and funding for the subsidising of the importation of the new volumes needed to be sourced. He justified the corporation’s actions by repeating Ughamadu’s earlier claim. Baru maintained that only $1.05bn had been taken out of the NLNG’s dividend.

If the Senate had looked into the corporation’s Monthly Financial and Operational Report, it would have seen that the NNPC had not been lifting or marketing its total daily crude to persons who could supply it with the volume of petrol Nigerians needed. The senators would have also noticed that the NNPC extended its DSDP contract three months prior to their inquiry. The logical question the lawmakers would have asked should have been, ‘If the NNPC could not pay for 445,000 barrels per day, could they not market it in parts to independent marketers?'

From January 2017 to June 2018, the NNPC lifted and sold/refined through DSDP contracts, identical volumes of oil. The corporation lifted 162,247,931.00 barrels of oil and refined or exchanged 162,247,924.00 barrels of that amount for petroleum products within this window.

The difference between these two volumes is just seven barrels. Both volumes represent a lifting of 297,299.51 and 297299.5 barrels per day.

After securing the NFSF account without the knowledge of the National Assembly and adding the Federal Inland Revenue Services crude oil which the corporation sells and pays to it as cash to the DSDP order, the NNPC began lifting more than 297,000 barrels of petroleum. This elicits a poser, was the corporation limited by funding from lifting more before? Or was it scared that its revenue earnings would be insufficient to subsidise the litres of petrol an increased volume of crude oil will produce?

Sighting a leaked internal document, an unpublished report worked on by the Facility for Oil Sector Transformation and Reform in Nigeria (FOSTAR) and the Premium Times Centre for Investigative Journalism (PTCIJ), revealed that in early 2018, the NNPC found itself in urgent need of acquiring an additional 42 cargoes of PMS more than the cargoes it had acquired through its DSDP swaps.

It claimed it needed these additional cargoes in order to shore up Nigeria’s then rapidly dwindling strategic supply of PMS. Noticing that it was short of money for this, it sent a written request to the Presidency, in the form of a formal letter, asking to be allowed to withdraw US$ 1.05 billion from the overseas dividend account of the NLNG, which the government has a 49 per cent stake in.

It would then use the cash from the dividends to purchase the additional PMS stock it needed. This request was granted, and the NNPC went ahead and purchased the PMS. The truth of this has never been acknowledged but the NNPC continued to purchase cargoes of PMS outside its original DSDP contract after the first supposed 42 ship-loads.

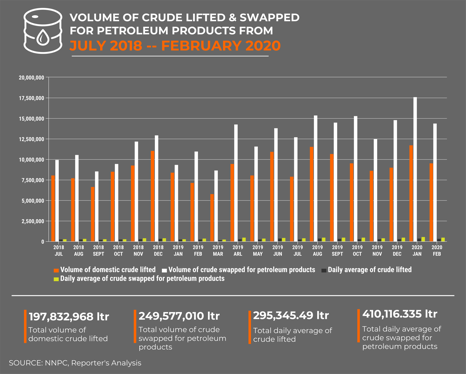

Between July 2018 when the DSDP was expanded and March 2020 when the corporation claimed It had no need for the ‘extended DSDP,’ the corporation refined 249,577,010.00 barrels of oil. When averaged per day, it falls short of 445,000 barrels still, the corporation refined a daily average of 410488.50 barrels.

Since the corporation said it had stopped purchasing what it defined as ‘flush volumes’ through its extended DSDP scheme in March 2020, it has up until October 2020 continued to lift more barrels outside its daily allocation. Could it be that it still helps FIRS convert its crude oil portion to cash through its extended DSDP contract? While Nigerians hope the NNPC will one day answer this, the corporation spent at least $4.57bn on lifting crude for petrol outside the DSDP deal for daily crude allocation between July 2018 and February 2020. It lifted a further $833.67m worth of petroleum outside its daily allocation between March and October 2020.

There is another angle to this tale however. Energy Educatio says a barrel of crude oil can produce no more than 73 litres of petrol. Going by the NNPC’s data, this site is wrong.

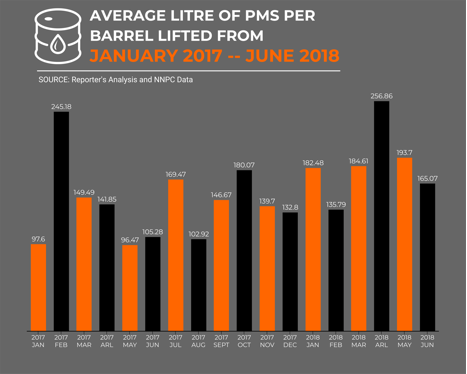

In the 18 months of report spanning January 2017 to June 2018, the NNPC averaged 157.00 litres of petrol per barrel of oil it refined. Energy Education reckons that there are 159 litres of different products in a single barrel of petroleum. It says the volume could swell to 179 litres during refining thanks to something called processing gain.

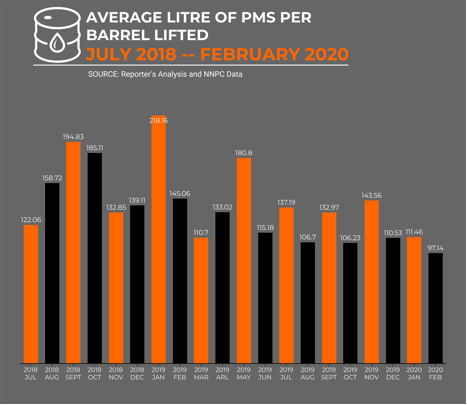

With increased barrels of oil to convert to petrol, came a reduced liter per barrel ratio. The corporation decreased the petrol it sourced from a barrel of petrol from 157.00 litres to 139.07 litres.

The NNPC’s refiners somehow found a way to more than double the litres of petrol in the petroleum they were given. An expert, who did not wish to be quoted for this report, suggested that the corporation sold off other petroleum products it obtained from the crude oil in its DSDP contracts. Despite being unable to carry its total crude allocation for financial or administrative reasons, the NNPC went ahead to extend its DSDP contracts and even add the FIRS’s crude allocation to its sale order. This the expert believes is to claim more as ‘under recovery.’

As reported earlier by SaharaReporters, the corporation had accumulated an excess of 3.5bn litres of petrol more than it distributed to the market between July 2018 and March 2020. The expert believes the corporation has been playing a phony game by inflating importation to withhold more revenue. The NNPC had two sources of ‘under recovery' for 20 months and the Senate appeared not to be savvy enough to question why.

The questions posed in this analysis and more were forwarded to Kennie Obateru, spokesperson for the NNPC. He promised to source answers from the officials in charge. That has, however, failed to happen as at press time.

This story was produced under the NAREP oil and gas 2021 fellowship of the Premium Times Centre for Investigative Journalism.