A firm, Panic Alert Security System Limited, owned by George Uboh, is also laying claim to $47,831,920.

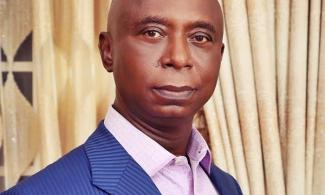

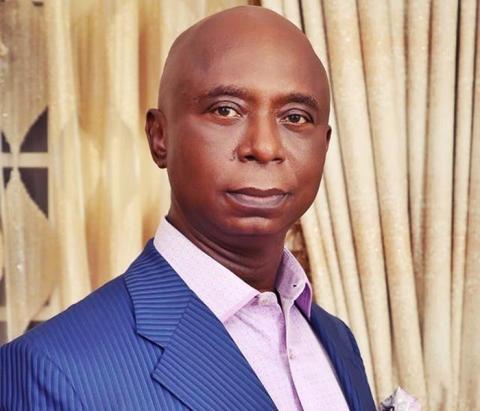

The Central Bank of Nigeria has stopped the payment of $418 million to Linas International Ltd, a company belonging to Prince Ned Nwoko, a former House of Representatives member and other consultants over the Paris Club refund.

SaharaReporters had reported how President Muhammadu Buhari re-approved the payment of the controversial millions of dollars in Paris Club refund to some creditors after being manipulated by the Attorney-General of the Federation, Abubakar Malami.

Documents seen by SaharaReporters had shown that the Debt Management Office (DMO) on September 27, 2021, issued 10 promissory notes valued at $4,783,192.00 each to the creditors.

They were asked to submit the original promissory notes to the CBN for dematerialisation.

One of those who stand to gain if the money is paid is Nwoko. The businessman is laying claim to $142,028,941 via a consent judgment he obtained from the Federal High Court in Abuja in the suit marked FHC/ABJ/CS/148/2017.

A firm, Panic Alert Security System Limited, owned by George Uboh, is also laying claim to $47,831,920.

“The Government of the Federal Republic of Nigeria by this Promissory Note, which is governed by the Laws of the Federal Republic of Nigeria, hereby unconditionally and irrevocable promises to pay to the order of: PANIC ALERT SECURITY SYSTEM LIMITED, the sum of four million, seven hundred and eighty-three thousand, one hundred and ninety-two dollars only on the 15th day of October 2022 (“Maturity Date”).

“This Promissory Note is backed by the full faith and credit of the Federal Government of Nigeria and charged upon the general assets of Nigeria. The Promissory Note also qualifies as an Instrument for Tax Exemption in line with the Tax Waivers approved for Bonds and Short-Term Federal Government of Nigeria Securities.

“This Promissory Note qualifies as a Liquid Asset for liquidity ratio calculation for banks. This Promissory Note is negotiable and transferable, subject to the submission of this original Note to the Central Bank of Nigeria. Holders are also required to submit this original Promissory Note to the Central Bank of Nigeria for dematerialization. In any case, this Promissory Note must be submitted to the Central Bank of Nigeria for payment at least two (2) working days before the Maturity Date,” one of the documents read.

However, the apex bank in a letter to some banks said the promissory notes “are not admissible or registrable on the scrip-less securities settlement system.”

A letter dated November 19, 2021, signed by CBN’s Director of Banking Service, Josephine Ajala and addressed to one of the financial institutions, Keystone Bank, read, “We are in receipt of two letters dated November 17, 2021, from your office, requesting for dematerialization of various FGN promissory notes for Prince Orji Nwafor-Orizu totalling $1,219,440:00 and Barrister Olaitan Bello totalling $215,195:00.

“Please be informed that we are unable to accede to your request because currently, Foreign Currency Denominated Promissory Notes are not admissible or registrable on the scrip-less securities settlement system (54) and as such, only Promissory Notes issued in Naira are registered and dematerialized on 54.”

Background

SaharaReporters had in a series of reports exposed wide-ranging legitimacy issues, including non-execution of agreed contracts and backdoor deals raised against the indebtedness from various quarters.

One of the beneficiaries is Dr Ted Iseghahi Edwards, who was indicted by the Economic and Financial Crimes Commission (EFCC).

Documents seen by SaharaReporters showed that Edwards did not represent the Association of Local Governments of Nigeria (ALGON) as claimed.

A letter dated August 1, 2018, by former EFCC Chairman, Ibrahim Magu, to the Ministry of Justice/Attorney General Office, indicted him of an attempt to defraud the Nigerian government.

It said, “The suspects had filed applications in court to be joined as one of the judgement creditors during the garnishee proceedings and the applications were refused by the Federal High Court. The judge in a ruling delivered on the 27th of June 2016 frowned on Dr Ted Edward for brandishing a judgment purportedly delivered by the Federal Capital Territory on 30th October, 2015 and in fact, took a swipe at it.

“By the Motion Ex parte filed on the 30th of March, 2015, the judgement creditors applied for a Garnishee Order Nisi which was granted on 1st April, 2015 and fixed the return date for 16th April for the Garnishee to show cause why the Order Nisi should not be made absolute.

“The Honorable Judge in his ruling stated unequivocally that let me state right away that the substantive matter was commenced by me until I entered judgement on the 3rd of December, 2013. I have searched my records up to the date I entered judgement. I could not find the name of Dr Ted Iseghahi Edwards as representing the judgement creditors even for one day nor did I find any process filed by his law firm. How then was that judgement prosecuted?

“Another point to highlight is the fact that according to the purported letter of engagement being bandied by Dr Ted Edwards, he was engaged on September 15, 2011, long before the matter was filed in court quoting the exact judgment sum.

“What this throws up is the fact that the said letter of engagement was done after 3rd December, 2013 and backdated to make it look as if the suspect had been engaged before the case started. There is no evidence to prove that the suspect did any work in relation to the recovery process.

“A careful look at the memorandum of settlement Dr Ted Iseghohi Edwards and Hon Odunayo Ategbero betrays the conspiracy and an attempt to defraud the Federal Government by the suspects.

“Pending Actions; Invitation and/or Arrest of the suspect, Dr Ted Iseghahi Edwards with a view of confronting him with all the issues raised in the evaluation above. Tracing and filing interim forfeiture order on any property or asset acquired with proceeds of fraud by Dr. Ted Iseghahi Edwards.”

SaharaReporters gathered that despite the report, Malami persuaded Buhari to approve $159 million as legal fees to Edward.

They also directed the DMO and the Ministry of Finance to release the promissory notes to Edwards and others so that they could take their shares, a source had said.

“Edward was the Secretary-General of ALGON when the Paris Club refund case FHC/ABJ/CS/130/2013 was done by Joe Agi (SAN) and his colleagues before Justice Ademola. It is clear that he was not the lawyer to ALGON and this much ALGON has said in writing to Malami and the Chief of Staff, Gambari,” the source had told SaharaReporters.

“The EFCC in its report to Malami and (Ibrahim) Gambari also established that Ted Edwards did not represent ALGON and that Ted Edward in his own handwriting admitted that Joe Agi was the lead counsel for ALGON. He went to one Judge, Baba Yusuf and procured a judgement that he was the lawyer to ALGON in the Paris Club refund case.

“Yet, Malami who knows this is recommending that Ted Edwards be paid $159,000,000 as fees from ALGON instead of the actual lawyer. Will this not amount to double payment whenever Mr Joe Agi demands to be paid? From my investigation, Mr Joe Agi, ALGON and the Nigerian Governors’ Forum have all gone back to court to challenge the payment of the $418 million including that of Edward through promissory notes.

“Should Malami not take a second look at the suit and see if really there is any fraud as being widely alleged? Instead, he and the Chief of Staff tricked the President and subsequently directed the Debt Management Office and the Finance Office to release the promissory notes to Edward and others so that they can take their shares.

“The total sum of $418 million promissory note suggested by Malami to be paid is just a tip of the iceberg of what is coming unless he is stopped. Nigeria will become bankrupt before President Buhari leaves office. The anti-corruption war of Buhari has been effectively clipped by Malami and Gambari using their powerful offices to trick the President who really trusted them.

“All (that is) needed to be done is to allow independent people to go through the whole cases concocted on the advice of Malami and the truth will be seen and Nigeria saved of all these massive stealing.

“Why is Malami not challenging any of these court judgements? If I may ask; in most of all these claims, the EFCC had investigated, taken statements and established that none of the contracts was executed. The report was submitted to Malami and former Minister of Finance, Kemi Adeosun by Magu-led EFCC suggested the arrest and interrogation of Ted Edward and one Prince Nicolas Ukachukwu but he and Gambari suppressed the report.

“The same man suggested to be arrested is who Malami said should be given $159,000,000. ALGON had written several letters to him and (Kayode) Fayemi, who is the Chairman of Nigerian Governors’ Forum that all the jobs executed by Edwards and others were fake, not executed. Yet Malami in the face of this clear case of fraud tricked the President in a memo and said judgement was given against them.

“He also negotiated the debt to 50 percent and convinced the President to pay to avoid more damages. It’s high time President Buhari save his anti-corruption war by causing a thorough investigation of his appointees involved in this massive fraud.”

Others who stand to benefit if the money is paid include Ned Nwoko, who is laying claim to $142,028,941 via a consent judgment he obtained from the Federal High Court in Abuja in the suit marked FHC/ABJ/CS/148/2017.

Three beneficiaries laying claim to $143,463,577.76 via a judgment of the Federal Capital Territory (FCT) High Court in the suit marked FCT/HC/CV/2129/2014 are: Riok Nigeria Ltd, Orji Nwafor Orizu, and Olaitan Bello.

From the total money, Riok Nigeria Limited has a share of $142,028,941.95 (about 54 billion), Mr Nwafor is entitled to $1,219,440.45 and Mr Bello has a share of $215,159.36.

A firm, Panic Alert Security System Limited, owned by George Uboh, is also laying claim to $47,831,920 based on another “consent judgment” it obtained in suit number FHC/ABJ/CS/123/2018, which was filed as recently as 2018.