Three years after the maturity of his savings, the insurance firm has refused to pay him.

A Nigerian man, Kalu Ezekiel Emenike who registered with Niger Insurance Plc, for his personal pension & savings (FLEXI) has accused the insurance firm of failing to pay him his matured savings of N402,186.64.

According to Kalu, he opened an account at the Ikeja Branch of the company in May 2016.

But three years after the maturity of his savings, the insurance firm has refused to pay him.

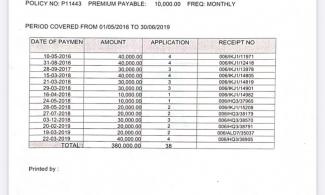

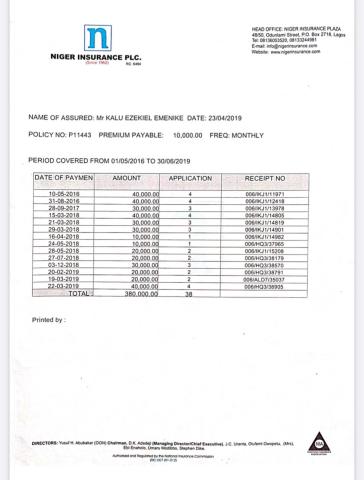

From the policy agreement Kalu signed with the company, he was to contribute the sum of N10,000 to Niger Insurance at the first day of every month for the period of three years (36 months) without extra premium.

With this agreement, Kalu was expected to receive his matured savings of N402,186.64 on May 1, 2019.

Upon the maturity date on May 1, 2019, Niger Insurance Plc on June 11, 2019 wrote to Kalu asking him to execute the discharge voucher and return to them to process his payment.

Part of the letter which was signed by an officer of the company, Miss Aminat Opaleye and an authorized signatory, Mr. Loveth Epelle, read, “Please find below our net payable of N402,186.64 in full and final discharge for the surrendering of the above numbered policy for your execution. Kindly execute the discharge voucher and return same to us to enable us process further for payment.”

Kalu said he executed the discharge voucher and returned to the company on June 14, 2019. But the company refused to pay him till date.

“It was in 2016 that I started saving. It is like a savings policy. I save N10,000 every month with them and the period is for three years. It wasn’t only me. I have gone to their office at Lagos Island. It is not only me that they are owing. They are also owing my sister over N800,000.

“After the savings, on the maturity date I went to them and they said I should bring the policy documents. I brought the policy documents and the discharge voucher, but still they didn’t pay me my money. First month passed and I didn’t hear from them. I went to them and they started using Covid-19 as an excuse, saying that they have issues with their money.

“Few months ago, I called one of their staff and the staff told me that they were trying to put up some of their properties for sale and when they sell them, they would pay me but since then, nothing has happened. In fact, there have been so many stories,” Kalu told SaharaReporters.

He added that the company initially complained that some staff engaged in dubious acts, using people’s names to collect claims and that affected the company.

Kalu said he reported Niger Insurance Plc to the Nigerian Insurers Association on September 6, 2019 and on September 12, the association wrote to him informing him that they had written to Niger Insurance Plc but after that, nothing more was done about his matter.

“I have gone to the Lagos State Office of Public Defence. They invited Niger Insurance but they didn’t show up. They wrote them and they didn’t respond to date,” Kalu said.

When SaharaReporters contacted the authorised signatory, Mr. Loveth Epelle, he said, “Our own is to process the payment and send to the headquarters. When it comes to payment, we don't have a hand, we don’t have a clue how they handle the thing. So, their file is at the head office. They are the ones that arrange the payment. Anything that has to do with payment is with the account office at the head office.”

When contacted by SaharaReporters, Alhaji Garuba Garkuwa, who was said to be in charge of the Account Department and responsible for executing payment to customers angrily questioned why he must explain to the reporter what happened between the company and Kalu.

“I will tell you precisely, I’m highly disappointed at you as a professional. How can you as a professional, somebody because he has a contract with a company, because they have not paid him, then you can go to the extent of writing to the person you don’t know who the person is, telling him to explain to you why that man has not been paid,” he said.

“It is a business contract. Had it been you called and said, Alhaji Garuba please, my brother has issue with Niger Insurance and he has not been paid yet, please what is going on, it is a simple thing. Man to man. But you just said you are a journalist and you want an explanation, who are you to ask me this kind of thing? Don’t call me. Don’t talk to me about this. It is Niger Insurance. I am not Niger Insurance.”

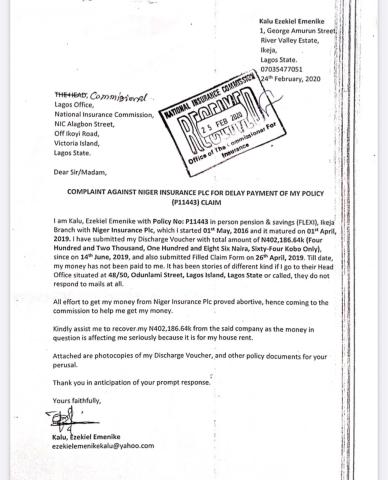

Meanwhile, Kalu said that on February 24, 2020, he wrote to the National Insurance Commission but nothing was done about his case and in May 2020, he also reported the matter to the Federal Competition and Consumer Protection Commission (FCCPC), which wrote the insurance company, directing it to act on Kalu’s matter.

“I am directed to request that you cause an investigation into the immediate and remote cause of the incident and to revert to the Commission with your findings. This should be done within ten (10) days from the date of the receipt of this letter to enable the Commission expedite action towards amicable resolution of the case. Please be guided by your obligation under the Federal Competition and Consumer Protection Commission Act,2018,” FCCPC letter to Niger Insurance Plc read.

However, the company never responded to FCCPC’s letter nor acted on the matter till date.

Kalu told SaharaReporters that was his only savings and had planned to use the money to start a business.

“But since the past three years, I have been frustrated, while the company is doing nothing about my money.”