He started observing malfunctions in the machine as customers’ accounts get debited and his own wallet was not credited.

A point of sale (POS) agent identified as Oluwakorede Noah has raised the alarm over the refusal of Crowd Force, a distribution network, to address complaints of failed financial transactions for over a month.

Noah told SaharaReporters that his POS business has recorded losses running into N250, 000 because of the company's refusal to contact the bank and trace unsuccessful transactions.

According to Noah, he was introduced to the company's product, PayForce and had been an agent on the platform. However, he started observing malfunctions in the machine as customers’ accounts get debited and his own wallet was not credited.

He said the machine complicates the issue by noting that the transaction had been approved which increases the impatience of the customer who had already been debited. However, Noah said he had only recorded losses as this amount does not get credited to his own account (wallet).

He said efforts made to ensure the company resolves the dispense error issues had proved abortive, adding that he only had about N9,000 left to run his business.

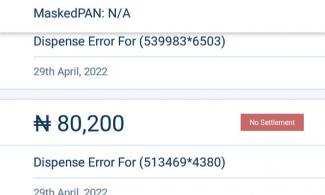

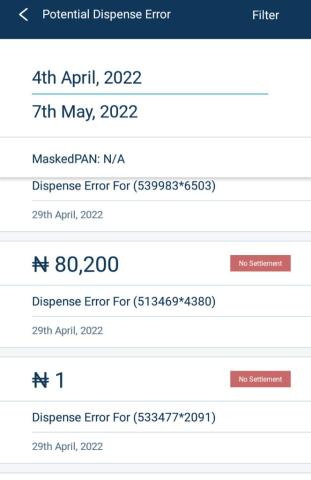

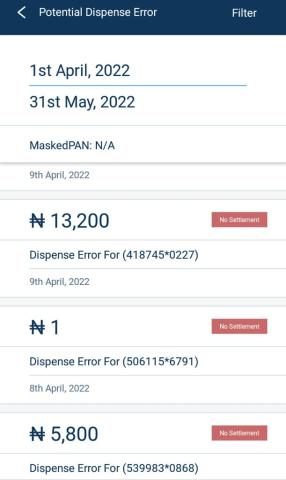

He said, “I have been working with PayForce as a POS agent. We started noticing N1 dispense error on every transaction from them and we didn't notice it early enough until someone told us how to check it.

“There was one transaction that happened N80,200; the whole money just disappeared. There was no money in our wallet and the customer had been debited. I reached out to them through several messages; they would ask me to input my username, sponsor, etc. but funnily enough, my sponsor (field agent) has not been reachable since January.

"If you call him, he'll tell you he's in the bank, etc. Now the guy is nowhere to be found, they have no office here in Lagos.

“Another thing is the other contact they shared with us said he resigned from the company in February and they kept sending his number to us to call him. The guy said he had already left for another job and that he could send his resignation letter to me if I didn’t mind, I informed the company about this, and then they said their regional manager would reach out to me.

“Till now, as I speak, the entire loss is in the range of N250, 000. They told me they would send N5,000 to one of my customers but I felt; how does that have anything to do with me?

“I am a graduate but ventured into POS business to take care of my family but now they want to swindle me, they asked me to go to the bank. How can I go to the bank for a transaction that had been done? They should be the ones to go to the bank.

"As I speak now, we don't have the cash to run the business because everything we have invested is gone. We have only N9,000. It's like there's someone at their bank end that is stealing from customers. They have refused to rectify the problem.

“They keep telling us not to give customers money if we are not sure. How am I supposed to do that when the machine is defective? When you do a transaction, it's supposed to approve it. When it approves, it is supposed to credit the wallet. But now, it won't credit and approve, sometimes it won't show anything and the customer is desperate. When you tell them that they'll get a reversal, only a few of them understand.

“What I'm asking Payforce to do is help us identify these people. There's a way they can approach the bank for such.

“I want the world to know that dispense error issues do not occur through the POS operator, it is a symptom of a failing or a faulty system. Hence with immediate effect, I hereby call on relevant regulatory agents of the government to help us look into this issue of systematic pilfering.”

When SaharaReporters contacted CrowdForce, the company's representative identified simply as Mariam confirmed that Noah had lodged a series of complaints about failed transactions.

The representative further explained that it is not the duty of the company on behalf of the agent except Noah can present evidence of the physical cash given.

“We treat declined transactions within 24 to 48 hours; this is because when a transaction occurs, we don't get reports until the day after. What we always tell our agents is that whenever there's a failed transaction, they should hold on for 24 hours before we can get a resolution.

“It is only until then that we can state if the transaction is settled to us, then we can go ahead to pay but in a case where there is a declined transaction and the money was not settled to PayForce by the customer's bank, there is no way we will be able to make payments.

“In Mr Noah's case, he had a series of declined transactions, some of which were settled to us which he was funded for and then he had others which were not settled to us which he was not funded for and he complained about it.

“He paid his customers by receiving the credit from our end, that was what caused the loss on his part. We usually tell our agents that in the event that PayForce is not settled for a transaction, it means the customer's bank did not remit the funds to us. Hence if there is a debit, the customer should go to their bank and fill a dispense error form to get a reversal but in this case, he went ahead to pay without speaking to the customer service representative to find out the status of the transaction.

“If we are not settled for a transaction, we cannot lay claims to it. We have asked Mr Noah to tell his customers to go to the bank for a reversal. We cannot go to the bank to lodge a complaint on Mr Noah's behalf because for withdrawal transactions like this, we cannot tender proof of payment at the bank. It's just by word of mouth. He's telling us he made payment to these customers. We don't have physical evidence to tender to the bank."