Also, of the N21.83 trillion total budget, recurrent expenditure has the highest allocation of N8.33 trillion, representing nearly 40% of the budget.

President Muhammadu Buhari on Tuesday, January 3, 2023, signed the N21.83 trillion 2023 Appropriation Bill into law.

The budget which is possibly Nigeria’s largest budget in history as well as Buhari’s last budget as the President is based on a N10.49 trillion revenue, N11.34 trillion deficit and N6.31 trillion budgeted for debt servicing.

A further breakdown analysis of the budget done by the Nigeria's civic tech organisation, BudgIT, showed that from the total revenue of N10.49 trillion, independent revenue has the highest share of N2.62 trillion, Non-oil Revenue has N2.43 trillion, while N2.23 trillion will be gotten from oil revenue. Retained Revenue from GOEs is N2.42 trillion, and other revenue will generate N794.13 billion.

Also, of the N21.83 trillion total budget, recurrent expenditure has the highest allocation of N8.33 trillion, representing nearly 40% of the budget. This according to the budget includes a personnel cost of N5.02 trillion, overhead cost of N1.11 trillion, statutory deductions of N967.49 billion and pension, gratuity and retirees benefit at N854.81 trillion.

Further analysis of the budget showed that the sum of N6.31 trillion has been budgeted for debt service, representing approximately 29% of the total budget, while capital expenditure has N6.45 trillion, representing 27% of the budget.

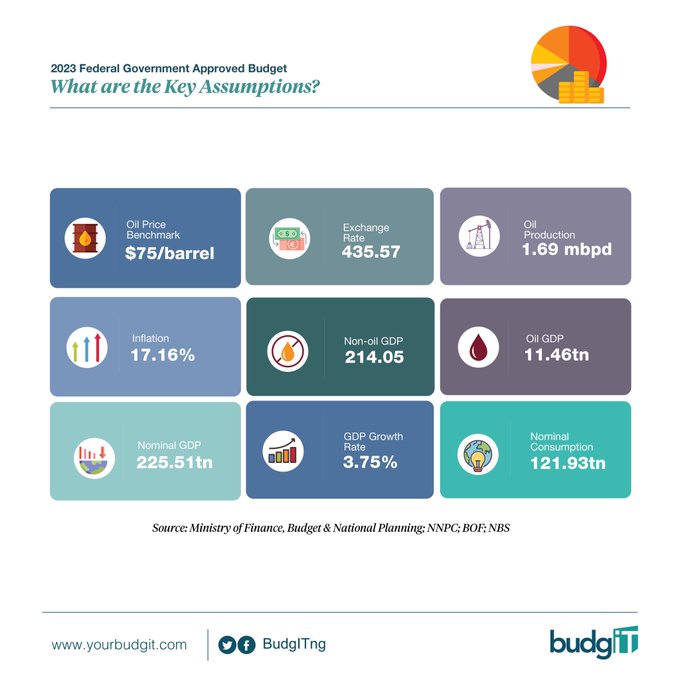

It could be noted that the 2023 budget is based on oil production of 1.69 million barrels per day at $75 per barrel. The projected GDP growth will be at 3.75%, with an exchange rate of N435.57/$ and an inflation rate of 17.16%. 5/5.

For the total revenue of N10.49 trillion, N2.23 trillion is expected to come from share of oil revenue; N2.24 trillion to come from Net GOE Revenue, including Operating Surplus; N2.62 trillion will come from Independent Revenue and N81.79 billion is expected to come from the dividends of the NLNG and Bank of Industry (BOI).

Also, N933.28 billion is expected to come from share of CIT (Citizen Investment Trust); while share of Customs is expected to give the country N949.59 billion; Education Tax (TetFund) is expected to produce N248.27 billion while N383.09 billion is expected to come from Value Added Tax (VAT) and other sources of revenue in the country will produce N631.26 billion.

From the budget analysis, the key assumptions include oil price benchmark of $75 per barrel; exchange rate at N435.57 per Dollar; oil production of 1.69 million barrels per day; inflation at 17.16%; non-oil gross domestic product (GDP) at 214.05 oil GDP at N11.46 trillion; nominal GDP at 225.51 trillion; GDP growth rate at 3.75% and nominal consumption at N121.93 trillion.