At the time, Shonubi was the CBN’s Deputy Governor (Operations).

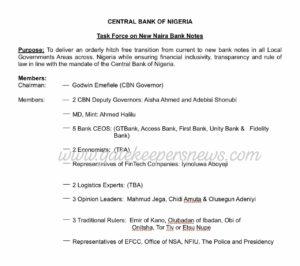

A report submitted by the Acting Governor of the Central Bank of Nigeria, Adebisi Shonubi to justify the implementation of the Naira Swap policy under the suspended governor, Godwin Emefiele.

At the time, Shonubi was the CBN’s Deputy Governor (Operations).

In the document exclusively obtained by Gatekeepers News, titled “Memorandum to the Committee of Governors for Currency Redesign,” dated August 2022, and approved by Shonubi, while serving as the Deputy Governor (Operations), the current acting governor of the apex bank premised his argument for the Naira Design Policy on the fact that huge numbers of naira notes had been hoarded by some people.

Shonubi’s report claimed Naira Redesign should be implemented because cash outside banks consisted of over 80% of the Currency in Circulation (CIC), a situation that increased the threat to financial system stability in the country.

The document reads in part: “Currency Management is a key function of a Central Bank. The integrity of the currency and efficient supply of banknotes are indicators of a performing central, especially in predominantly cash-based economies such as Nigeria in the eyes of the public function should be efficient, meet demand and present minimal issues.

“In recent times, currency management in Nigeria had faced a series of interwoven challenges that have affected the ability of the Bank to efficiently cony out its mandate of issuing legal tender (i.e. provision of an adequate volume of clean banknotes in the right denominational mix for members of the public).

“The challenges have continued to grow in scale with attendant consequences on the Bank's reputation, if left unaddressed.

“These challenges are primarily centred around wholesale hoarding of Naira banknotes by members of the public. An observation supported by statistics shows that cash outside banks consists of over 80% of Currency in Circulation (CIC).

“Worsening shortage of banknotes in circulation attendant negative public perception of the Bank and increasing threat to financial system stability. High and increasing cost borne by the Bank, and other participants in Nigeria's currency management sector banknote production storage processing distribution activities and High counterfeit risk evidenced by reports from security agencies.

“The Bank must take decisive action to address these challenges in holistic terms.

“This memorandum appraises the design and security features of the existing Naira banknote series and highlights the challenges resulting from the long-term circulation of same.”

“The memo concludes with recommendations for a phased redesign of our Naira banknotes which by virtue of section 19 of the CBN Act As amended in 2007) will require the approval of the president, upon recommendation by the Board of Director.

“It is noteworthy that the Bank had previously embarked on a currency restructuring distinct from currency redesign) exercise codenamed ‘Project CURE' in December 2011. The project had however been halted by the then President Dr. Goodluck E. Jonathan GCFR in the aftermath of public outcry in respect of inadequate information on some aspects of the project.

“Worthy of note is the distinction between a currency restructure exercise, which denotes a change in the denominational structure of the Naira (i.e. addition and/or removal of denominations coining banknotes or vice versa). A currency redesign, on the other hand, denotes only making amendments to the specifications of existing banknote denominations amendment/addition/colour swap/removal of design and security features).”

The policy caused Nigerians hardship as the mopping up of old N1,000 and N500 notes led to cash paucity in the country, as the newly printed notes were grossly insufficient.

The Naira Swap was invalidated by the Supreme Court on the grounds that it was not done with due consultation and in line with constitutional provisions.

The apex court ordered that the old N1,000, N500 and N200 notes shall continue to be used side by side with the newly redesigned notes till December 31, 2023.