A Senior Advocate of Nigeria, Femi Falana, has said that the embattled former Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele and the management of the apex bank under his leadership ought to be prosecuted for incitement and culpable homicide, having misled Nigerians to believe that sufficient cash was distributed to commercial banks to replace the trillions of naira mopped up frsystem.

According to Falana, “N3.5 trillion old naira notes were mopped up from the system with only N402 billion released to deposit banks” during the implementation of the naira redesign policy adopted under Emefiele’s leadership at the bank.

Falana lamented that Nigerians were caused acute hardship by the CBN under the leadership of Emefiele with the naira swap and redesign policy, hence, the apex bank should pay compensation to the families of those who were killed as a result of the incitement of members of the public.

In January, the CBN claimed that it had supplied commercial banks in the country with enough cash in line with its currency design policy, with Emefiele saying then that at least N1.9 trillion old naira notes had been returned to banks by Nigerians, with N500 billion more to go.

“So far and since the commencement of this program, we have collected about N1.9 trillion; leaving us with about N900 billion.

“We held several meetings with our Deposit Money Banks (DMBs) and provided them with Guidance· Notes on processes they must adopt in the collection of old notes and distribution of the new notes to all Nigerians. These include specific directives to DMBs to load new notes into their ATMs nationwide to ensure an equitable/transparent mechanism for the distribution of the new notes to all Nigerians.

“We are happy that so far, the exercise has achieved a success rate of over 75 percent of the N2.7 trillion held outside the banking system. Nigerians in the rural areas, villages, the aged and vulnerable have had the opportunity to swap their old notes; leveraging the Agent Naira Swap initiative as well as the CBN Senior staff nationwide sensitization team exercise,” Emefiele had said.

The apex bank also directed security agencies to arrest and prosecute bank officials who were accused of sabotaging the new currency policy.

In February, before the presidential election, former President Muhammadu Buhari said that N2.1 trillion worth of old naira notes had been returned to banks which were mandated to return same to the CBN.

“Notwithstanding the initial setbacks experienced, the evaluation and feedback mechanism set up has revealed that gains have emerged from the policy initiative,” Buhari had said.

“I have been reliably informed that since the commencement of this program, about N2.1 trillion out of the banknotes previously held outside the banking system, had been successfully retrieved. This represents about 80% of such funds.”

Governors elected under the umbrella of the ruling All Progressive Congress (APC), appealed to the then President Buhari to allow both the old and new naira notes to co-exist to ease the suffering and bring succour to Nigerians.

Former Governor Nasir El-Rufai of Kaduna State had after a meeting between the governors and Buhari, said that Nigerians were suffering and traders were losing their goods due to a lack of patronage.

The governors added that while the CBN mopped up over N2 trillion of the old notes, it printed only N300 billion, which was not enough.

Due to the hardship caused to Nigerians, Falana and Falana’s Chambers, however, wrote to the Central Bank on February 16, 2023, requesting information on the disbursement of new naira notes to banks.

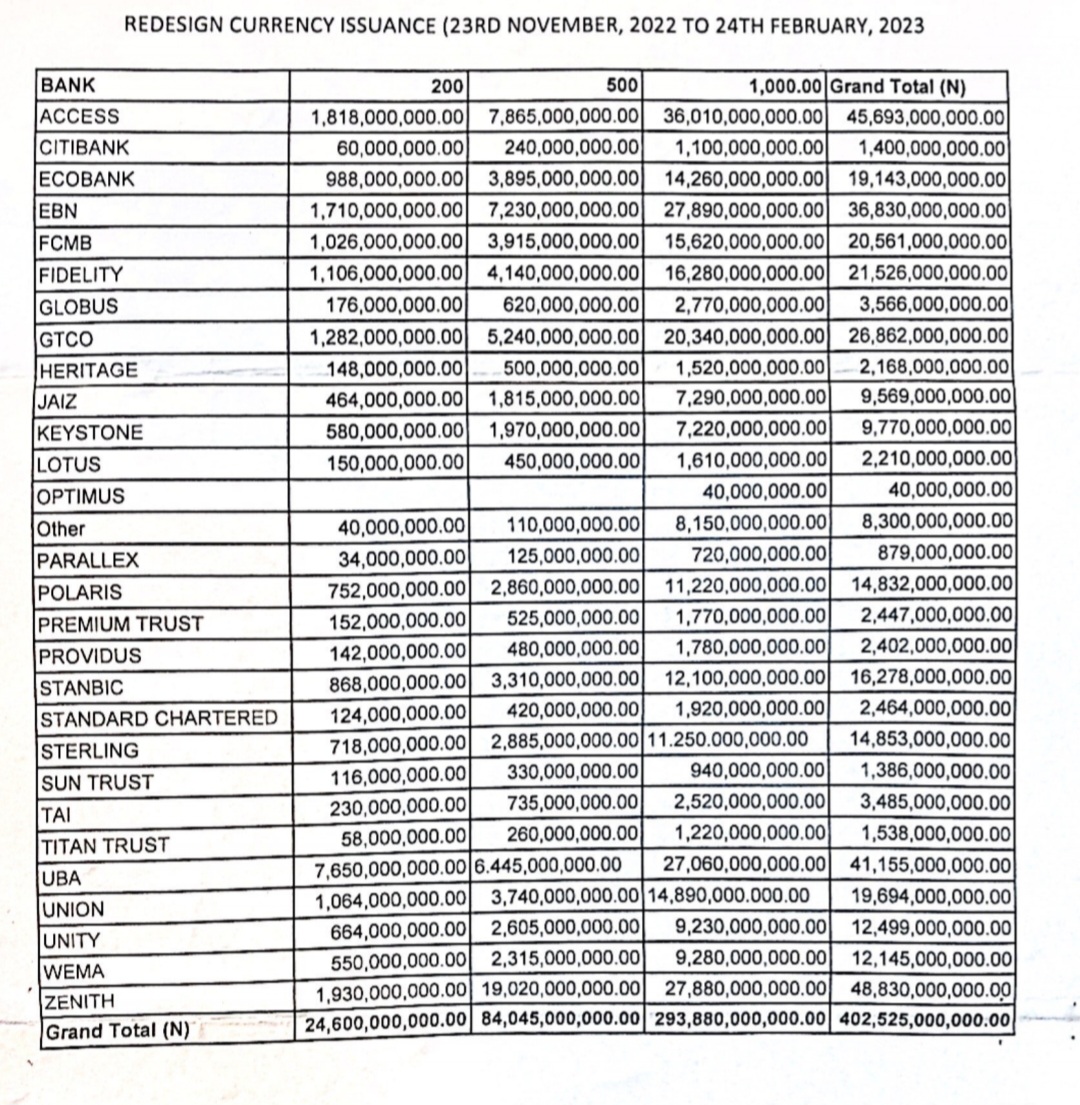

In its response dated September 13, 2023, which was signed by Aminu Mohammed for the Director and Secretary of the Board, the apex bank provided the details of funds disbursed to banks between November 23, 2022 and February 24, 2023.

According to the information, the apex bank only disbursed N402 billion to banks within the period while it mopped up trillions of naira from the system.

The information says Access Bank got N45.6 billion, Citibank got N1.4 billion, Ecobank received about N19 billion; First Bank PLC got N36.8 billion, FCMB got N20.5 billion, and Fidelity Bank got N21.5 billion.

Others include Zenith Bank which got N48.8 billion; UBA, N41.1 billion, Union Bank, N19.7 billion; Unity Bank N12.5 billion, Wema Bank, N12.1 billion while Polaris received N14.8 and StanbicIBTC Bank, N16.2 billion.

Globus Bank, N3.6 billion; GTCO, N26.9 billion; Heritage, N2.1 billion; Jaiz, N9.6 billion; Keystone, N9.8 billion; Lotus, N2.2 billion; Optimus Bank, N40 million; Parallex, N879 million; Premium Trust, N2.5 billion; Providus Bank, N2.4 billion; Unity Bank, N12.5 billion; Standard Chartered, N2.5 billion; Sterling Bank, N14.9 billion; Sun Trust, N1.4 billion; Tai, N3.5 billion; Titan Trust, N1.6 billion and others, N8.3 billion.

Falana in a statement on Sunday said, “In January 2023, the Central Bank of Nigeria claimed that it had supplied the commercial banks in the country with enough cash in line with its currency design policy.

“The apex bank purportedly directed security agencies to arrest and prosecute bank officials who were accused of sabotaging the new currency policy. Based on the statement, Nigerians trooped to the banks to collect cash. As the cash was insufficient, customers became angry.

“The mass anger over the cash crunch provoked customers who burnt bank buildings and destroyed Automated Teller Machines in some states. The violence paralysed social and economic activities and claimed not less than five lives while many others were injured. But for the Supreme Court, which extended the deadline for the withdrawal of the old Naira notes up until December 31, 2023, the cash crunch would have made life more unbearable for the Nigerian people.

“Convinced that the suspended governor of the Central Bank, Mr. Emefiele had lied and deceived the Nigerian people, we requested information about the actual amount made available to each of the commercial banks. In its belated response to our request, the CBN has now confirmed that it issued redesigned currency notes of N402 billion to the banks.

“Having misled Nigerians to believe that sufficient cash was distributed to commercial banks to replace the sum of N3.5 trillion mopped up from customers, Mr. Godwin Emefiele and the entire management of the CBN ought to be prosecuted for incitement and culpable homicide. In addition, the CBN should rebuild the bank buildings that were destroyed and pay compensation to the families of those who were killed as a result of the incitement of members of the public.”