Dangote Sugar Refinery Plc sued the Federal Inland Revenue Service, asking the Tribunal to enter judgement on the revised final additional assessment in the sum of N220,973,124, a tax liability already paid covering 2008 to 2013 years of assessment.

The Lagos Zone of the Tax Appeal Tribunal has ruled that Dangote Sugar Refinery Plc has paid all the tax liability owed to the Nigerian Government following the payment of the revised final additional assessment in the sum of N220,973,124.

Dangote Sugar Refinery Plc sued the Federal Inland Revenue Service, asking the Tribunal to enter judgement on the revised final additional assessment in the sum of N220,973,124, a tax liability already paid covering 2008 to 2013 years of assessment.

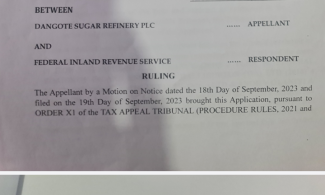

Dangote Sugar in a Motion of Notice Marked Appeal No: TAT/L Z/VAT/025/2016, brought pursuant to order XI Rule 1 of the Tax Procedure Rules 2021 and under the inherent jurisdiction of this court, sought two reliefs and five grounds.

The reliefs sought are: "AN ORDER of this Honourable Tribunal entering Judgement on the revised Final additional assessment in the sum of N220,973,124 (Two hundred and Twenty Million, Nine Hundred and Seventy-Three Thousand, One Hundred and Twenty-Four Naira Only), a tax liability already paid by the Appellant.

"And for such other order or orders as this honourable Tribunal may deem fit to make in the circumstances."

An affidavit in support of the motion for judgement deposed by La Kadri Yusuf, Tax Manager in Dangote Sugar PLC, disclosed that the Appellant commenced the appeal against the Respondent vide a Notice of Appeal dated and filed on November 9, 2016, challenging the Notice of Assessment against the Appellant for Value Added Tax, Withholding Tax, Companies Income Tax and Tertiary Education Tax for 2008- 2013 years of assessment, totalling N6,945,519,986.00.

Yusuf avowed that the Appellant made a payment of N64,732,765.00 of the undisputed liability.

The company in the appeal filed through its counsel, Dare Sokoya, however, stated that after the appeal was instituted before the Tribunal, parties continued to meet in a bid to amicably resolve the case.

It noted that several meetings were held by the parties and reports were made to the court on the progress made.

Following the meetings, he said that the Respondent (FIRS) revised the Appellant/Applicant's tax liability to N220,973,124, as the full and final payment of the tax liability for the relevant years in dispute.

The counsel further told the Tribunal that upon receipt of the Revised Notices of Assessment, the Appellant subsequently made payment, the receipt of which the Respondent acknowledged.

"The terms of settlement have been duly prepared and executed by the Appellant/Applicant. However, the execution thereof by the Respondent has been delayed owing to the Respondent's internal bureaucratic procedures. This delay has consequently impeded the finalization of the case.

"That the Rules of this Honorable Tribunal allow for an Appellant/Applicant to make an application at any stage of the proceedings such as this, and the Honorable Tribunal is empowered to hear same,” the counsel said.

In the affidavit, the tax manager also stated that there were no outstanding disputed issues before the Tax Appeal Tribunal for determination, adding that terms of settlement had been prepared and sent to the Respondent (FIRS) for signature since May 2023.

It reminded the tribunal that it had granted two adjournments at the instance of the Respondent's failure to execute the terms of settlement.

"That the Respondent has foot-dragged the signing of the agreed terms of settlement, having received the sum of N220,973,124.00 which is the revised assessment that has been paid by the Appellant.

"That the Appellant/Applicant has now applied that Judgement be entered in this case as all outstanding issues have been resolved and outstanding payments made and acknowledged by the Respondent," the affidavit said.

The Tax Appeal Tribunal in a unanimous decision ruled that the Appellant/Applicant had fulfilled its obligations.

It was subsequently discharged.

The court judgement obtained by SaharaReporters on Monday shows that the judgement, delivered on November 17, 2023, was read by the Chairman, Prof. A. B. Ahmed Esq and concurred by four honourable members - PA Olayemi Esq, Babatunde E. Sobamowo Esq, Samuel Ohwerhoye Esq and Terzungwe Gbakighir Esq.

The Tribunal held: "It is in the light of the above that this Honorable Tribunal has resolved the sole issue in this case in the affirmative.

“We hold that from the circumstances of this case, the Appellant/Applicant has fully discharged its additional assessed liability in the sum of Two Hundred and Twenty Million, Nine Hundred and Seventy-Three Thousand, One Hundred and Twenty-Four Naira Only (N220, 973, 124).

"Accordingly, this application is hereby granted and it is hereby Ordered, thus; A consent judgement of this Honorable Tribunal in the revised sum of Two Hundred and Twenty Million, Nine Hundred and Seventy-Three Thousand One Hundred and Twenty-Four Naira Only (N220, 973, 124), in favour of the Appellant/Applicant.

"An Order that the executed terms of settlement have been fully adopted as the judgement of this Honourable Tribunal.

"The already settled amount in the sum of Two Hundred and Twenty Million, Nine Hundred and Seventy-Three Thousand, One Hundred and Twenty-Four Naira Only (N220, 973, 124) should be deemed as the Final and Conclusive settlement in this matter."