Etim Asaenyi holds over 50 hectares of land he uses for palm and cassava cultivation.

Asaenyi, who is over 70 and now the Village Head of Orukimin Mbo Local Government Area of Akwa Ibom State, recalls how he became popular in the area and rich as a trader in palm oil and kernel from the palm plantation.

However, his business crashed when the government asked him and others in the community to surrender part of their land for a state-owned palm plantation.

"I lost 95 per cent of my land to the government," he recalled. The village head added that many families lost their entire ancestral land to the plantation and now cultivate on leased farmlands.

Asaenyi said his people received no compensation for the land but had hoped the plantation would benefit Akwa Ibom State and also spur their community's rapid development.

In nearby Etebi Idung Assan in Esit Eket Local Government Area, community members said they had seen no benefit from donating their ancestral farmlands to the government for the palm plantation. The acting Village Head of Idung Etahnam in Etebi Idung Assan, Chief Etang Umoh, said the plight of most members of the community is aggravated by the debt owed to plantation workers and conflicts over the small size of land the community has left to cultivate.

The concerns expressed by the leaders of Urukim and EtebiIdung Assan offer a glimpse of the suffering caused by their loss of livelihoods due to the government's taking of their land for the plantation.

Money Spinning Investment Dies, Resurrects in Controversial Form

According to data from the state's 2020 audited financial statements, Akwa Palm Industries Limited had an investment value of N146.64 million until 2021, with the Akwa Ibom State Government owning 95.42 per cent of the shares.

The investment, incorporated on February 18, 1988, at the Corporate Affairs Commission (CAC) with Registration number 109111, is on a 3,000-hectare Oil Plantation and has over 200,000 oil palm trees and a 300,000-capacity nursery for oil palm seedlings.

The plantation stretches across six communities in three Local Government Areas (LGAs) – Orukim and Unyenge in MboLGA, Etebi Idung Asang, Ntak Inyang and Akwa Ata in EsitEket LGA, and Udung Ukpo in Uruefong Oruko LGA.

However, the business failed due to mismanagement, leaving a multimillion-dollar debt owed to workers and contractors. This led the government to strike off the investment at CAC in early 2021.

The state government incorporated another company, Dakaada Global Oil Palm Limited, to manage the palm oil business. Incorporated at CAC on February 16, 2021, with Registration number 1758213, the state government invested N100 million in addition to the N146.64 million equity stakes of Akwa Palms Industries, making a total equity stake of N246.64 million, as reported by the 2021 audited financial statements.

According to the State Audited Financial Statements of 2022and 2023, the state government invested N100 million yearly from the 2022 to 2023 fiscal years to raise the equity of the Dakaada Global Oil Palm Limited to N446.6 million.

Interestingly, the state government in its Audited Financial Statements between 2021 and 2023, reported that it holds a 100 per cent stake in Dakaada Global Oil Palm Limited.

However, contrary to the claims, the N300 million public funds invested in the company in the last three years were actually for a business owned by top state politicians and other business endeavours owned by non-Akwa Ibom indigenes.

Robbing Peter to Pay Paul

In addition to the N300 million public funds spent on the company's share capital, checks into the 2021 Audited Financial Statement of the State revealed that in 2021, the state government took a N500 million loan from Polaris Bank to invest in the project.

However, an investigation revealed that the loan was for individuals' private interests. Findings also revealed that the government's claim of 100 per cent ownership was false.

A certified true copy of the Status Report of the Company, dated September 13, 2024, from the CAC revealed five owners (Persons with Significant Control) of the company – Olusanya Yusuf Liadi, Umo Eno Bassey, Akpan Edna Augustine, Nkanang Gabriel Emmanuel and EkuwemEmmanuel Effiong.

Also, the company's total share capital filed at the CAC in February 2021 is different from what the state government reported in its financial statement.

According to the 2021 audited financial statements, as of January 1, 2021, the share capital of Dakaada Global Oil Plamwas N146.6 million. But the government on February 16, 2021, filed N100 million share capital for the company.

The status report notes that Olusanya Yusuf Liadi, who represents the interest of Balham Nigeria Limited (RC:949460), holds the highest share (30 million) in the company.

Furthermore, although four other shareholders have either held political offices or are related to top government officials in Akwa Ibom, according to the Status Report, they all denied being politically exposed.

For instance, Mr. Umo Eno, who was appointed as a Person with Significant Control of the company on February 16, 2021, a month earlier, was appointed by Governor UdomEmmanuel to the Akwa Ibom State Executive Council and sworn in as Commissioner for Lands and Water Resources in January 2021. Governor Emmanuel was to later work for his emergence as Governor of Akwa Ibom State.

According to the Status Report, Mr. Umo Eno was removed as a director of the company on May 18, 2022, during his electioneering period but remains a shareholder to this day, even as the Governor of Akwa Ibom State.

Prof. Edna Augustine Akpan, who holds 20 million shares, was appointed by the Udom Emmanuel administration as a Director of Commercial Farm, Akwa Ibom State Technical Committee on Agriculture and Food Sufficiency.

Nkanang Gabriel Emmanuel, although not a government appointee, is Governor Udom Emmanuel's elder brother. He holds 20 million shares in the company. This is not the only government investment that he holds shares in. An investigative report by Guardpost.ng showed that he holds a 50,000 equity share in a state government investment called Akwa Prime Hatchery, which is now moribund.

Ekuwem Emmanuel Effiong, who has a 20 million equity stake, was the Secretary to the State Government under UdomEmmanuel's administration.

Investment Income Unaccounted for

According to Focus Economics, a world-leading business forecast organisation, a metric tonne (1000 litres) of palm oil in the third quarter of 2024 (July through September) sold for 1,082 US dollars (US$). The retail price range of Nigeria’s palm nuts and kernels is between US$ 2.92 and US$ 3.89 per kilogram. Even though the state government's financial statements claim it owns the palm oil plantation, checks into the state's 2021 through 2023 Audited financial statements show no investment income recorded for this investment in the last three years despite it being a highly sought-after commodity in the local and international markets.

When TheMail Newspaper visited the plantation's host communities in September, members told this newspaper that hardly a month passes without palm fruit being harvested twice and taken away in trucks. Military men heavily guard the plantation.

Government in Spiral of Silence over Discovery

A freedom of information request to the Managing Director of the Akwa Ibom State Investment Corporation (AKICORP), Mr. Imo-Abasi Jacob, and the Commissioner for Finance, Mr. Linus Nkan, in mid-October, requested to know the investment income and ownership of the Dakkada Global Oil Palm Limited.

While the Ministry of Finance failed to respond to the request despite acknowledgement, AKICORP, in a letter dated October 21, ignored questions on the investment income and asked the newspaper to find out the company's ownership structure through CAC. When this reporter met with the Managing Director of AKICORP on October 25 for explanations on the company's investment income and ownership, he declined to comment. He asked that all questions be in writing.

A follow-up request to AKICORP on October 28 specifically requested to know the equity stake of Akwa Ibom State in the investment among the shares of the five individuals listed as beneficial owners. The newspaper further asked about the process of acquiring the shares of the company and the criteria for appointing those individuals as shareholders in an investment reported to be owned 100 per cent by the state government in government audited reports. Despite acknowledgement of this request, responses have not been made as of the time of filing this report.

The newspaper also asked the Commissioner for Agriculture, Mrs Offiong Offor, through a text and WhatsApp message, who is cultivating the plantation at the Dakaada Global Oil Palm and how much has been generated to the state’s coffers from the investment since 2021. This was not responded to.

This is not the only agricultural investment in which public funds have been invested, yet with controversial ownership and viability.

Coconut Refinery fails to go commercial two years after inauguration

Twelve months in office, Governor Udom Emmanuel’s administration incorporated the St. Gabriel Coconut Plantation and Oil Refinery Limited on June 3, 2016, with Registration number 1339790 at CAC.

The government acquired farmlands in 13 communities in Ikpa Ibom Clan, Mkpat Enin LGA for the project. The Chairman of the Village Heads of the 13 project host communities, Eteidung Raymond Udia, said lands were taken without the owners’ consent and no compensation was paid.

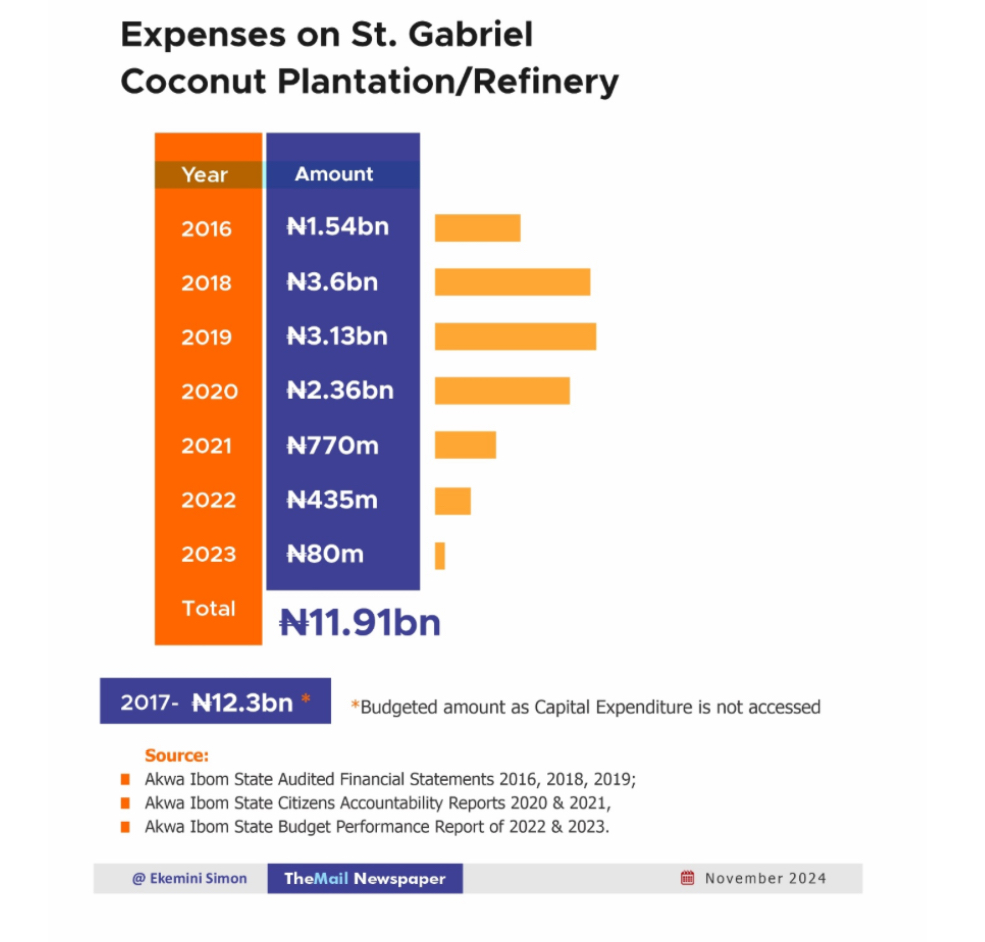

For the period this reporter could access capital expenses in the Audited Financial Statements, N11.91 billion was spent on the project, with VKS Construction as the construction company and T&I Global Limited, an Indian Tea Machinery Manufacturing company, installing the machines.

However, according to the 2019 Audited Financial Statements, the state government obtained a loan of N5 billion from Zenith Bank in 2019 to mobilise VKS construction for the coconut refinery.

Four years after the loan was obtained and two years after the inauguration of the investment, N1.38 billion out of the N5 billion was yet to be settled as of December 31, 2023, according to the Akwa Ibom State 2023 Audited Financial Statements.

The refinery had not commenced operation 29 months after its inauguration.

When TheMail Newspaper visited the St. Gabriel Coconut Factory in mid-October, it was not operating. Workers who refused to have their names in print for fear of victimisation told TheMail Newspaper that the only work taking place at the facility was machine maintenance.

The state’s approved budget shows that N390 million was voted for the maintenance of infrastructure at the coconut refinery by the Ministry of Agriculture.in 2024.

The workers and credible sources at the Ministry of Agriculture told the newspaper that the coconut refinery was yet to be certified for commercial business.

TheMail Newspaper on October 25 and October 30 visited the Ministry of Agriculture to see the Commissioner for Agriculture, Mrs. Offiong Offor, on our findings about the coconut factory. The commissioner was not on the seat on both days. Further calls on October 31, November 1 and 4 were not responded to. Text and a WhatsApp message sent to her phone line on October 30 was neither acknowledged nor responded to.

The message asked what is keeping the St. Gabriel Coconut Refinery from going commercial and what the government is doing to address the concerns.

The government's handling of the business has unearthed more controversial issues, including whether Akwa Ibom citizens will get value for the billions of naira invested in the coconut plantation and refinery.

St. Gabriel investment not Quoted as State Government Investment

After inaugurating the billion-naira investment in May 2022, the state government was expected to list St. Gabriel Coconut Plantation and Refinery Limited among its investments. However, the Audited Financial Statements of 2022 and 2023 did not record the company among the 17 investments in which the state holds equity either in full or in part.

When the Commissioner for Finance, Mr. Linus Nkan, was contacted about these findings, he said he needed to check the financial statements again to cross-check the claim and would get back to the reporter. He did not get back to the reporter as of the filing of the report.

The story was supported with funding from the Centre for Journalism Innovation and Development (CJID)