Independent auditors raised significant concerns, cautioning that Unity Bank’s ability to continue as a going concern was at serious risk.

In August 2024, the Central Bank of Nigeria (CBN) announced the merger of Unity Bank and Providus Bank to stabilise the country’s financial sector and mitigate potential risks.

A review of Unity Bank’s recently published 2023 financial statement by SaharaReporters has exposed the severity of its financial challenges, highlighting its struggle to remain operational.

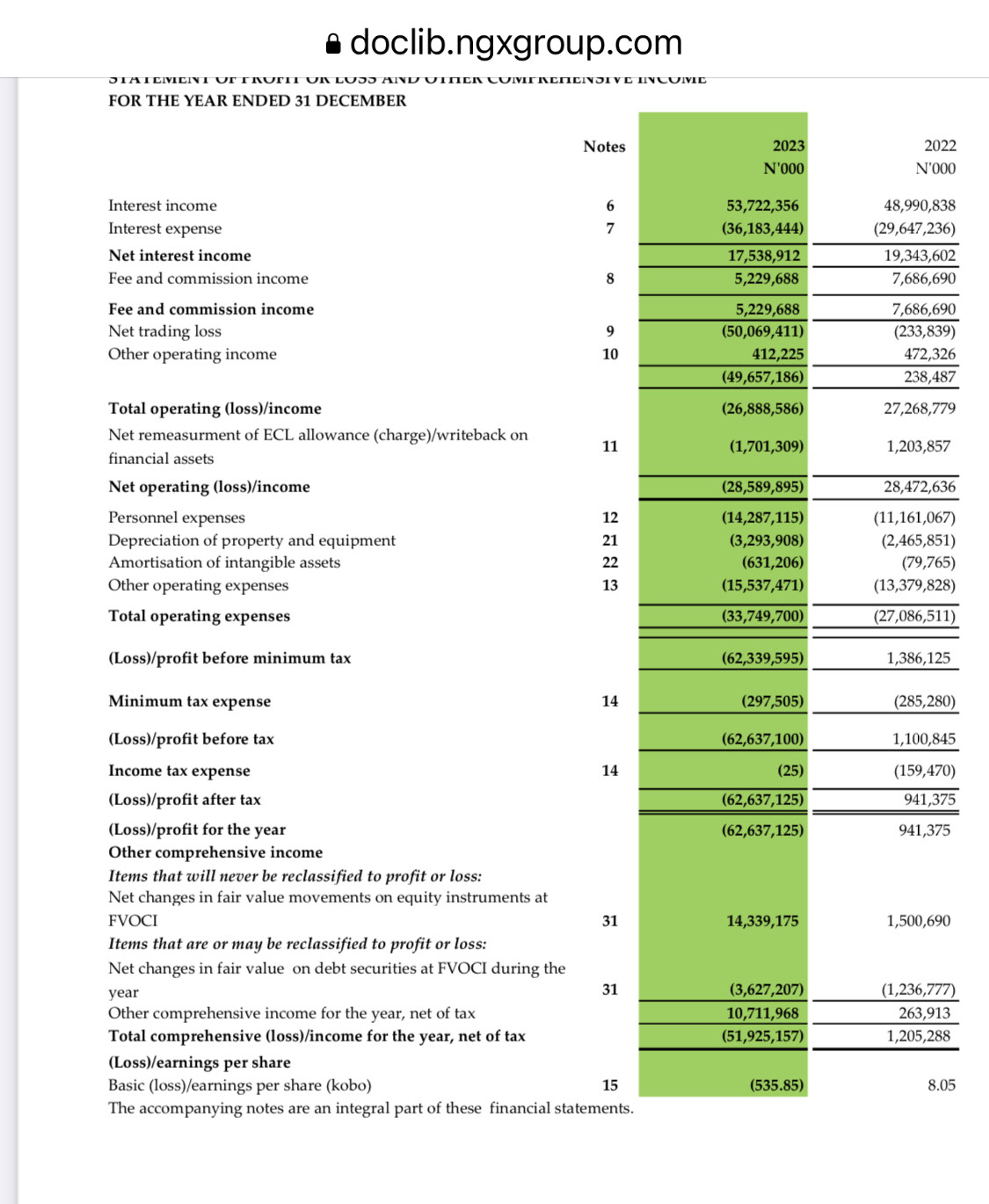

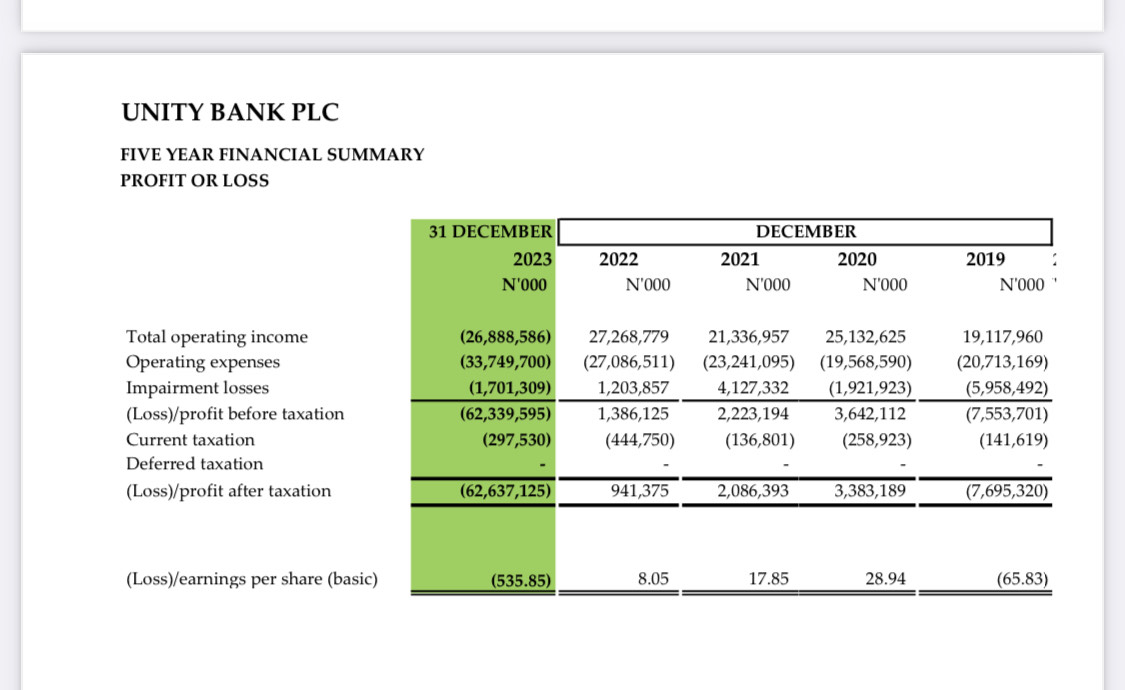

The bank reported a massive N62.6 billion loss in 2023, a stark contrast to the N941 million profit recorded in 2022.

Independent auditors raised significant concerns, cautioning that Unity Bank’s ability to continue as a going concern was at serious risk.

"The bank made a loss after tax of N62.6 billion for the year ended December 31, 2023 (2022: Profit after tax N0.94 billion).

“As of that date, the bank’s total liabilities exceeded its total assets by N326.9 billion (2022: N274.9 billion), and its capital adequacy stood at -76.14% (2022: -89.69%)," the auditors noted.

The report also revealed that Unity Bank did not meet the CBN’s minimum capital requirement of 10%, creating “material uncertainty” about its ability to remain operational.

Non-Performing Loans And Debt Crisis

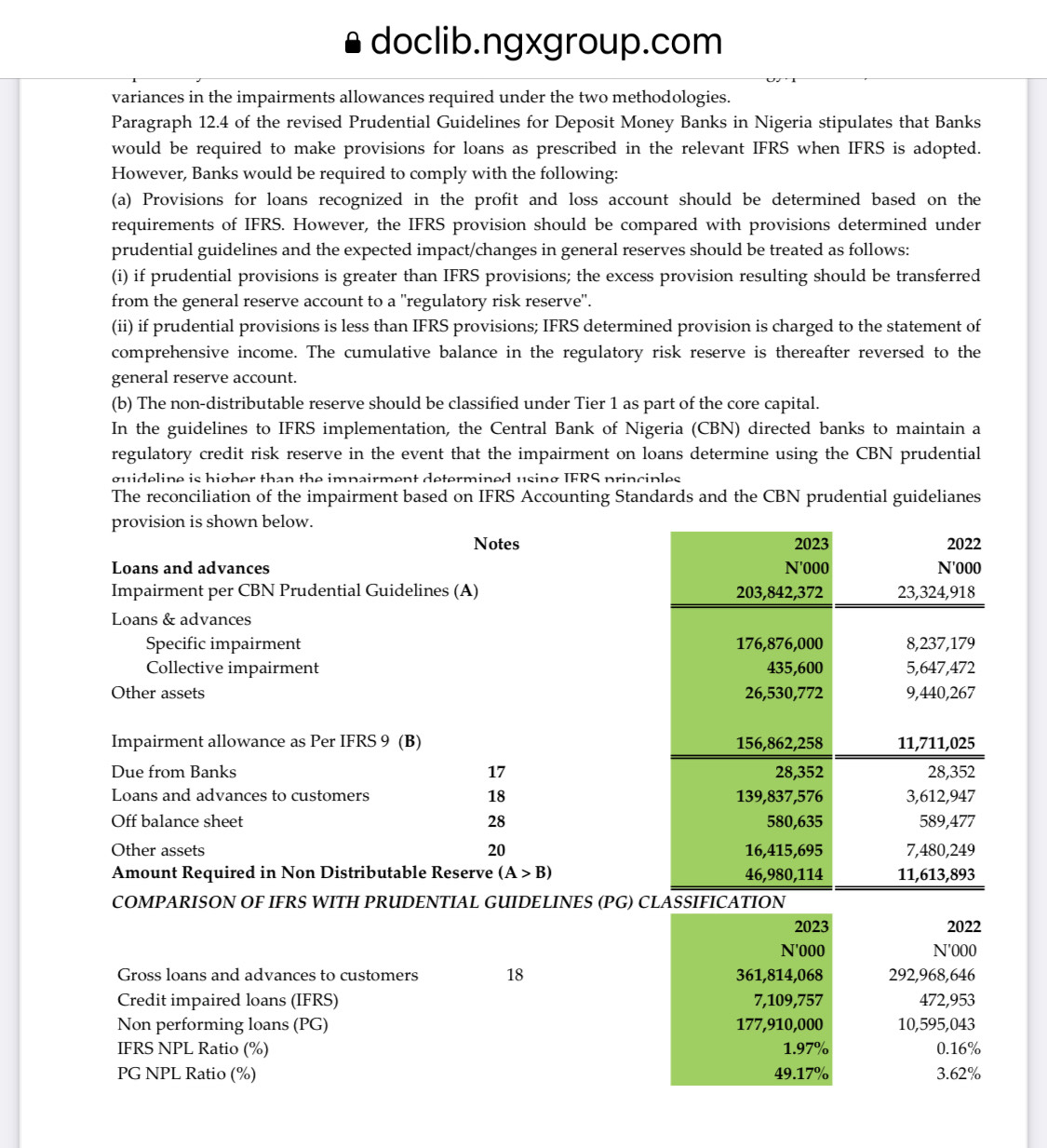

An in-depth review of Unity Bank’s financials reveals that non-performing loans (NPLs) surged to N177.9 billion in 2023, up from N10.5 billion in 2022—a dramatic increase that significantly contributed to the bank's collapse.

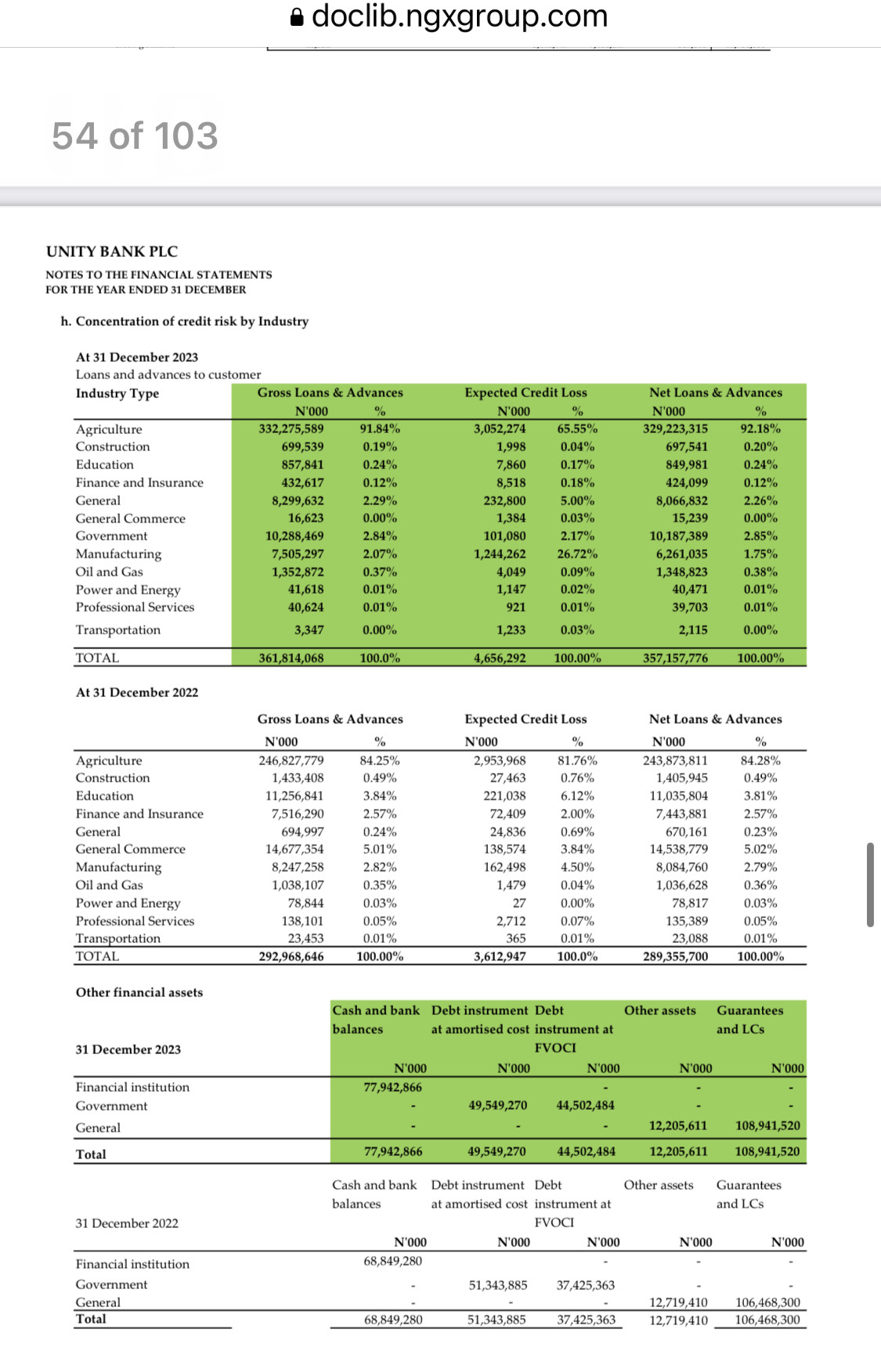

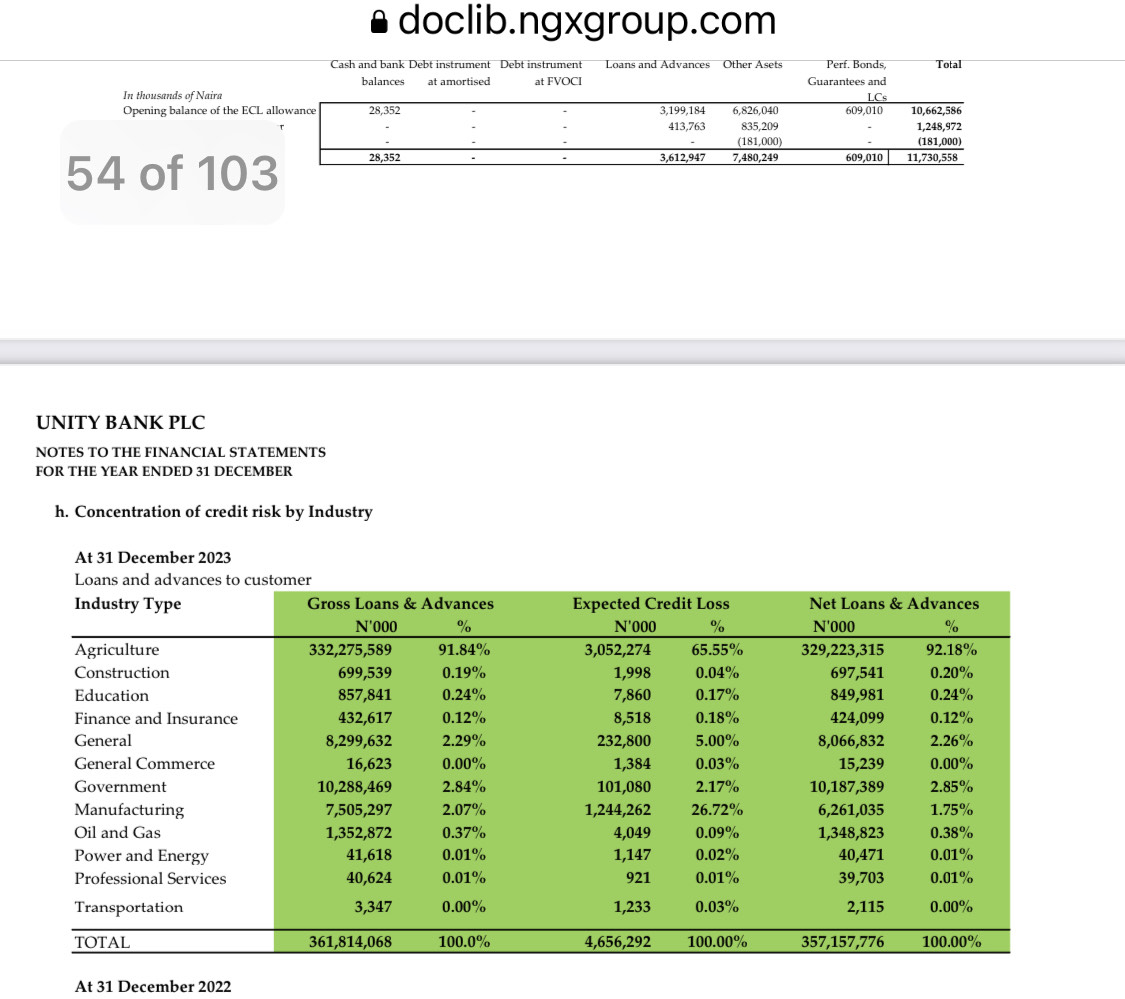

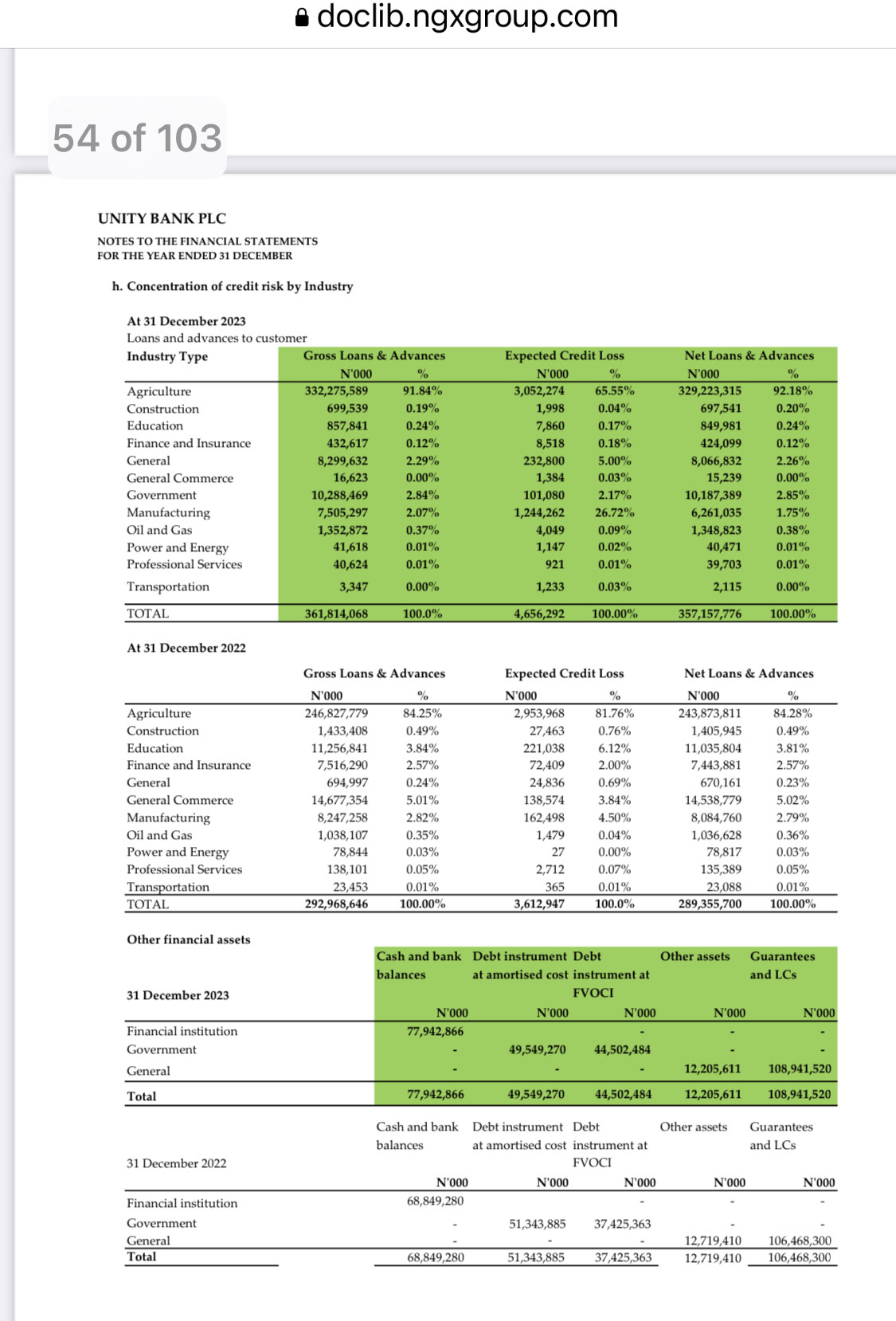

NPLs are loans where borrowers have either defaulted or are unlikely to repay. The analysis shows that the agriculture sector received the lion's share of loans, amounting to N332.2 billion (91.84%) of Unity Bank’s total lending as of December 2023.

The “government” was the second-largest debtor, owing the bank N10.288 billion.

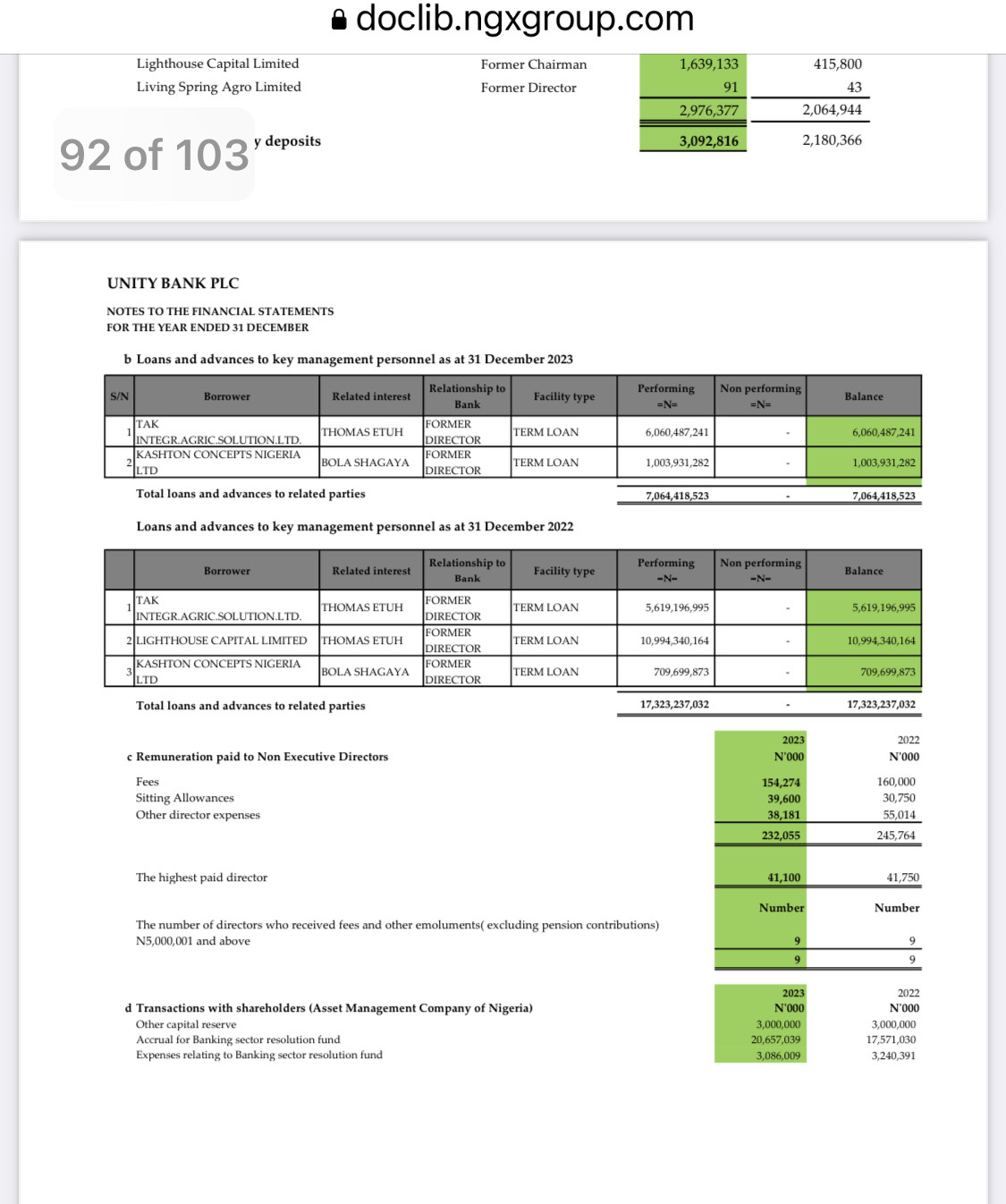

Additionally, two former directors of the bank owed over N7 billion at the end of 2023.

Tak Integrated Solution Limited, associated with Thomas Etuh, a former Unity Bank director, owed N6.060 billion as of December 31, 2023. Another company Kashton Concepts Nigeria Limited associated with former director, Bola Shagaya, also owed the bank N1 billion.

Apart from bad loans, rising operational costs further impacted Unity Bank’s financial health. Fuel and motor running expenses jumped from N147 million in 2022 to N218 million in 2023.

Electricity and power expenses jumped from N466 million to N783 million, while diesel costs increased from N873 million to N1.042 billion.

Between 2019 and 2023, Unity Bank’s highest profit was N3.3 billion in 2020, reflecting its struggle to maintain financial stability before its eventual collapse.

To sustain Unity Bank before the merger, the apex provided a N50 billion loan, scheduled to mature on December 31, 2024.

As part of the merger deal with Providus Bank, the CBN also extended a N700 billion facility to support the transition, effectively absorbing Unity Bank’s financial distress and maintaining stability in the banking sector.

The collapse of Unity Bank highlights underlying structural issues within Nigeria’s banking industry, amid similar challenges faced by other banks in the country.