SaharaReporters learnt that this is over petitions Igini submitted to the Economic and Financial Crimes Commission (EFCC) and the Governor of the Central Bank of Nigeria (CBN) alleging grave unethical banking practices.

A new layer of controversy has emerged in the unfolding financial dispute between First Bank of Nigeria Limited and Broron Oil and Gas Company Limited as the bank filed a lawsuit against human rights lawyer, Barrister Mike Igini.

SaharaReporters learnt that this is over petitions Igini submitted to the Economic and Financial Crimes Commission (EFCC) and the Governor of the Central Bank of Nigeria (CBN) alleging grave unethical banking practices.

The suit was instituted against Igini in his personal capacity, despite the fact that he acted strictly as counsel to his client, Broron Oil and Gas Ltd.

SaharaReporters learnt of what investigators described as a deeply troubling pattern of alleged fraud, manipulation of accounts, forgery of transfer mandates, and diversion of funds within the operations of First Bank, claims that have reportedly eroded trust and left customers vulnerable.

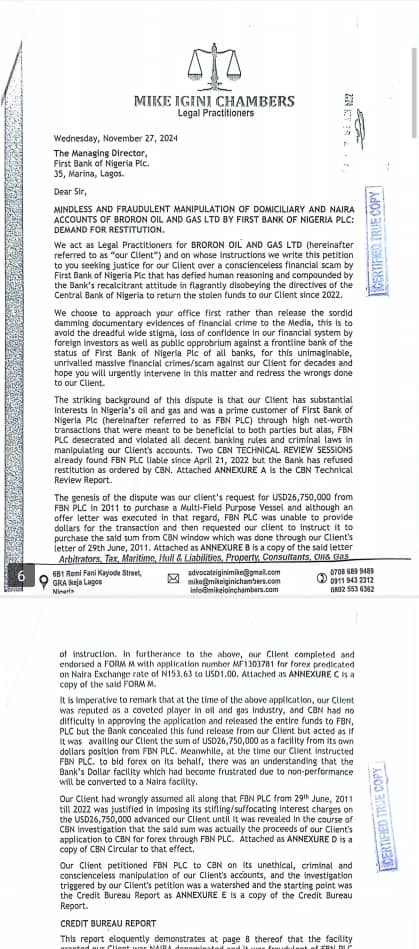

SaharaReporters gathered that Broron Oil and Gas Ltd had formally briefed Barrister Igini to petition both the Managing Director of First Bank and the CBN Governor after the company allegedly suffered massive financial losses amounting to millions of dollars and naira due to what they termed “unethical banking conduct” by First Bank.

In response, Igini, through Mike Igini Chambers, addressed detailed petitions to the CBN and the EFCC, outlining complaints including alleged mismanagement of Broron’s accounts, withholding of approved foreign exchange allocations, diversion of loan facilities, unauthorised withdrawals, and use of forged or replicated transfer mandates bearing fake Broron letterheads.

The matter prompted the CBN’s Consumer Protection Department to conduct a three-day technical session between April 21 and April 23, 2022, involving First Bank and Broron representatives.

SaharaReporters gathered that the apex bank arrived at clear findings of fact and directed First Bank to refund all millions of dollars and naira withdrawn from Broron’s account “under questionable and unexplainable circumstances.”

However, despite the said findings and the directives, the CBN has been unable to enforce compliance with its directives since 2022.

One of the most contentious issues relates to an alleged $26.7 million forex bid Broron was said to have applied for through First Bank for the purchase of an operations vessel.

Broron claimed that the CBN approved the forex application for BRORON, not First Bank, and that First Bank falsely claimed the dollars used were its own loan funds.

The firm further claimed that, based on the alleged falsehood, First Bank collected over $32 million from Broron’s account.

It was gathered that documents exchanged between the CBN and EFCC, dated September 29, 2021, confirmed that the forex was approved directly to Broron.

Another allegation concerns a $9.2million loan granted by the Bank of Industry (BOI) to Broron, which First Bank allegedly refused to release.

Instead, the bank allegedly traded with the funds while using Broron’s own dollars within the bank to pay interest on the loan for over two years.

The Bank of Industry later demanded the return of the funds when it discovered the irregularities.

SaharaReporters learnt that the EFCC has invited officials of both First Bank and the CBN for questioning over issues including alleged forgery, fraudulent transfer mandates, questionable forex transactions, and withholding and diversion of funds.

SaharaReporters gathered that in a letter dated December 3, First Bank's solicitors, Interlegal Partners & Notary Public, accused Igini’s petition of constituting a “threat” and disclosed that the bank had filed a suit not against Broron, but against Igini personally.

The bank referenced an existing suit marked Suit No: FHC/L/CS/1280/2021 – First Bank of Nigeria vs. DSV Avianna & Broron Oil & Gas Ltd, arguing that Igini’s petition interfered with a pending court matter.

Igini, in his response, denied being informed of any subsisting suit by his client and insisted that a lawyer’s letter requesting amicable resolution does not amount to a threat.

He emphasised that the court cases are civil in nature, whereas the EFCC is probing crimes that fall outside civil jurisdiction.

It was also gathered that the CBN, in a letter dated February 28, 2025, confirmed its own ongoing efforts to resolve the dispute.

Following Igini's continued petitions, First Bank initiated a separate legal action marked Suit No: LD/ADR/5756/2025 – First Bank of Nigeria Limited vs. Michael Igini, before Justice Okusanya of the Lagos State High Court, Osborne Division.

The case came up on November 7, 2025, during which Igini’s counsel moved a Preliminary Objection seeking dismissal of the suit with punitive costs.

Justice Okusanya adjourned the matter to February 4, 2026, for ruling.

Broron Oil and Gas, a major player in Nigeria’s energy sector and a prime First Bank customer, recently won an oil block under the current administration, a development that heightened the significance of the dispute.

Sources alleged that First Bank is displeased that an issue it had “warehoused” in court through repeated adjournments since 2021 is now back under public scrutiny due to Igini’s petitions and ongoing EFCC engagement.

The unfolding legal battle is expected to intensify in the coming months as regulatory agencies pursue multiple strands of investigation into First Bank’s conduct, while the Lagos High Court prepares to rule on the bank’s controversial suit against Mike Igini.