The RFCC unit cracks heavy residues into lighter, more valuable products like gasoline, diesel, and petrochemical feedstocks.

Despite assurances of growing self-sufficiency, the Dangote Petroleum Refinery continues to import diesel amid ongoing operational challenges linked to its Residue Fluid Catalytic Cracker (RFCC) unit, findings from multiple sources indicate.

The RFCC unit cracks heavy residues into lighter, more valuable products like gasoline, diesel, and petrochemical feedstocks.

Documents and shipping data obtained by SaharaReporters, alongside an industry report by global energy analytics firm Kpler, show that the refinery remains reliant on imported blending components.

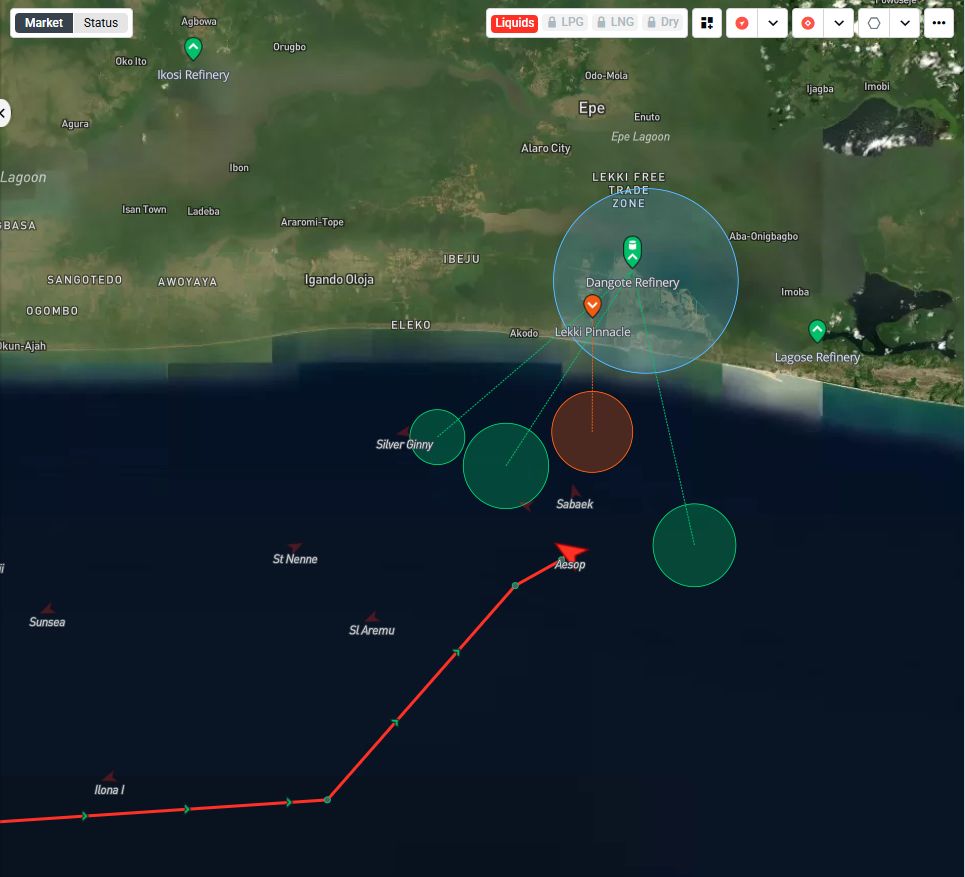

A shipping data also revealed a cargo of diesel en route to the refinery.

Diesel Cargo En Route to Dangote Refinery

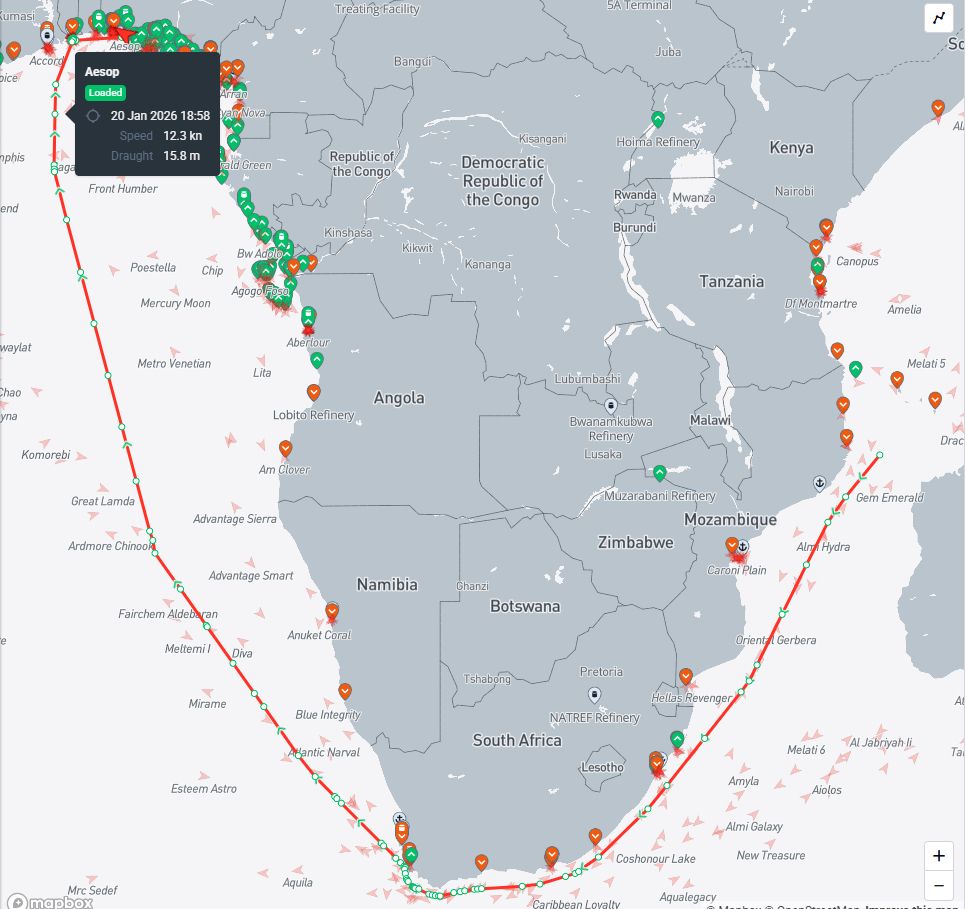

A source who shared vessel-tracking information with SaharaReporters confirmed that a Suezmax tanker, MT AESOP (IMO 1030399), loaded diesel cargo at Jamnagar Refinery in India and is currently en route to Nigeria.

According to the source, the vessel carried out a partial discharge in Lomé, Togo, on January 22 and 24, 2026, and is scheduled to fully discharge approximately 54,000 metric tonnes of diesel at the Dangote Refinery, with an expected arrival date of January 29, 2026.

“This is another vessel of AGO (diesel) imported by Dangote and set for discharge, despite marketers being barred from importing,” the source said, alleging regulatory double standards.

Quality Certification Confirms Diesel Import

Further confirmation came from a Certificate of Quality exclusively obtained by SaharaReporters, which shows that MT AESOP loaded High Speed Diesel (Gasoil) at Sikka Terminal, India.

The cargo was inspected by Saybolt Inspection Services India Pvt Ltd, with samples drawn from multiple ship tanks on December 27, 2025, and analysis completed on January 20, 2026. The certificate, issued on January 21, 2026, confirms that the diesel meets international specifications.

The report describes the fuel as clear and bright, with ultra-low sulphur content of just 9 parts per million, well below the 50 ppm maximum limit. It also met required standards for viscosity, flash point, cetane number, lubricity, and oxidation stability, making it suitable for commercial and environmental compliance.

RFCC Unit Remains Major Bottleneck — Kpler

Meanwhile, a separate Kpler report on the Dangote Refinery’s outlook for the first half of 2026 highlights persistent operational challenges, particularly with the RFCC unit, which is critical for gasoline production.

According to Kpler, the RFCC has been unreliable since April 2025, experiencing repeated shutdowns. Although a restart was initially expected in early February 2026, the timeline has now slipped to February 10, with further delays still possible.

As a result, the refinery has been unable to operate at full capacity. Crude processing in January 2026 was estimated at 280–300 thousand barrels per day, with only a modest increase expected in February.

The report notes that gasoline output has been constrained, forcing the refinery to rely on imports of blending components, estimated at about 45kbd in January, while exporting increased volumes of low sulphur straight run fuel oil (LSSR), averaging 120kbd.

Output Still Below Expectations

Despite the RFCC downtime, Dangote has continued limited gasoline production using other units, including the Continuous Catalytic Reformer (CCR) and isomerization units. However, overall production remains below projections.

In January, the refinery produced an estimated 95kbd of gasoline and 120kbd of middle distillates, including diesel and jet fuel. To mitigate disruptions, Dangote has reportedly shifted to processing lighter crude grades with API gravity between 37 and 39.

Kpler projects that if the RFCC restart holds, crude runs could rise to 350kbd in Q1 2026 and 400kbd by mid-2026, though the firm cautions that given the refinery’s track record, operations are likely to remain uneven.

“Dangote’s operation outlook remains uncertain as the RFCC restart has been pushed to 10February and could slip further. The 200 kbd RFCC remains the key bottleneck, keeping runs capped after repeated outages since April 2025,” the Kpler report said.

“January crude runs are estimated at ~280–300kbd and are likely to stay around 300–320 kbd into February, with gasoline output partly supported by imported blendstocks. Overall stabilization remains months away, and RFCC reliability risks should keep the gasoline ramp-up constrained into H1 2026.”

The importation of diesel by Dangote Refinery has raised fresh questions about Nigeria’s fuel import policies.

When contacted Dangote Refinery and Petrochemicals for comments, its CEO David Bird, said, “Dangote refinery is a fully flexible merchant refining, blending and trading platform.

“We import and process crudes and condensates in our crude distiller, we import and process intermediate feedstocks directly into our downstream conversion and processing units and we bring in blending components when market opportunities arise.”

“We continue to import intermediate feedstocks for processing into PMS whilst we undergo planned maintenance of our RFCC,” he said.

“With this flexibility built into our refinery design, we have continued, and will continue to supply Nigeria 45-50mln liters/day during this period.”