The review further showed that the state spent an additional ₦1.4 billion on “travel operations and logistics” during the 2025 fiscal year.

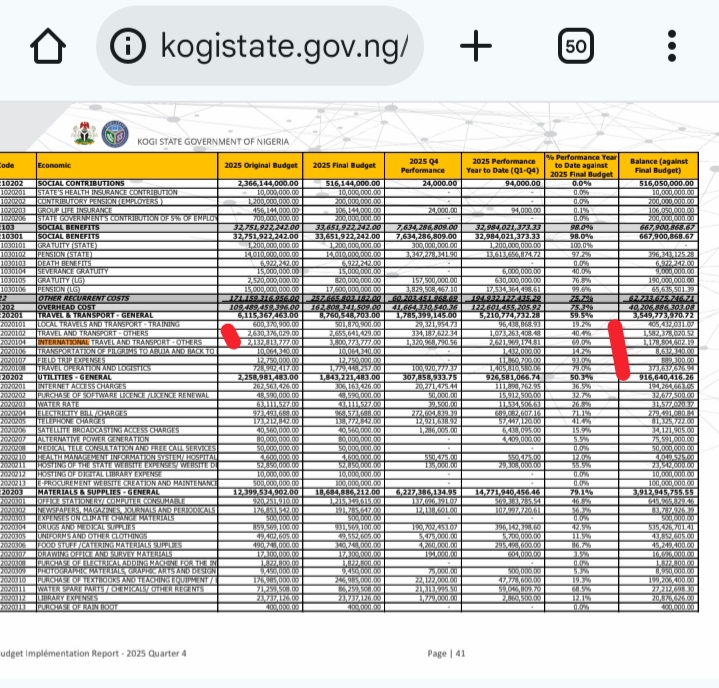

A SaharaReporters' review of the Kogi State budget performance document for the full year 2025 has shown that a total of ₦2.6 billion was spent on international travels by the administration led by Governor Usman Ododo.

Half of this amount, representing ₦1.3billion, was spent between October and December 2025 alone—a three-month period corresponding with the last quarter of the year.

The review further showed that the state spent an additional ₦1.4 billion on “travel operations and logistics” during the 2025 fiscal year.

Meanwhile, expenditures on honorarium, refreshments, meals, and welfare packages gulped ₦6.5 billion within the same year.

Earlier, SaharaReporters had reviewed the Kogi State draft budget document for the 2026 fiscal year and found that the state budgeted ₦1.015 billion for the remodelling of the Government House structure.

This was in addition to another ₦1 billion allocated for the Government House minor capital works, which are planned to be executed through direct labour.

Further review showed that the state also plans to spend ₦500 million on the construction of residential apartments for honourable members and the head of legislative services on an “owner occupier basis”.

This suggests that the lawmakers would own the houses to be built by the government using public funds.

These expenditures come amid growing concerns over the state’s rising debt burden.

Previously, a SaharaReporters' review of the Kogi State Medium-Term Expenditure Framework (MTEF) document revealed that 80.3% of the state’s Internally Generated Revenue (IGR) between 2025 and 2027 would be spent on debt servicing.

According to the MTEF document, which forecasts expenditures from 2025 to 2027, the IGR expected for 2025 is estimated at ₦35.1 billion.

In the same year, a sum of ₦27.9 billion is expected to be spent on public debt service.

This means that 79.4% of the state’s IGR is projected to be spent on debt servicing in 2025.

In 2026, the document estimates that another ₦35.1 billion will be generated by the state, while ₦28.2 billion has been earmarked for debt servicing.

By implication, the state plans to spend 80.4% of its IGR on debt service in 2026.

For 2027, expected revenue was also put at ₦35.1 billion, while public debt service is projected to gulp ₦28.5 billion. This would mean that 81.1% of Kogi State’s revenue would be spent on debt servicing in that year.

This development has raised concerns about the state’s ability to meet its debt obligations.

According to the MTEF document: "Kogi's 'Vulnerable' risk profile reflects a very high risk that the state's ability to cover debt service with its operating balance may weaken unexpectedly over our forecast horizon (2024-2028)."

"This may be due to lower-than-expected revenue, higher-than-expected expenditure, or an unexpected rise in liabilities or debt-service requirements."

The document further noted that the state’s revenue robustness remains weak.

"Kogi's revenue robustness is influenced by the state's overall weak socio-economic profile by international standards and reliance on volatile transfers from the federal government."

Concerns were also raised that about 80% of the state’s revenue depends on allocations from the Federation Account Allocation Committee (FAAC), while the remaining 20% from IGR falls below the national average for Nigerian states.

"About 80% of Kogi's revenue is made of federal allocated revenue, i.e. VAT and statutory transfers (over half of operating revenue) that are highly dependent on the sale of hydrocarbons. The proportion of internally generated revenue (IGR) of total operating revenue is less than 20%, below the Nigerian states' average."